<p id="8bd7" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">A year ago, we started building an investing app to bring power back to the stakeholders.</p>

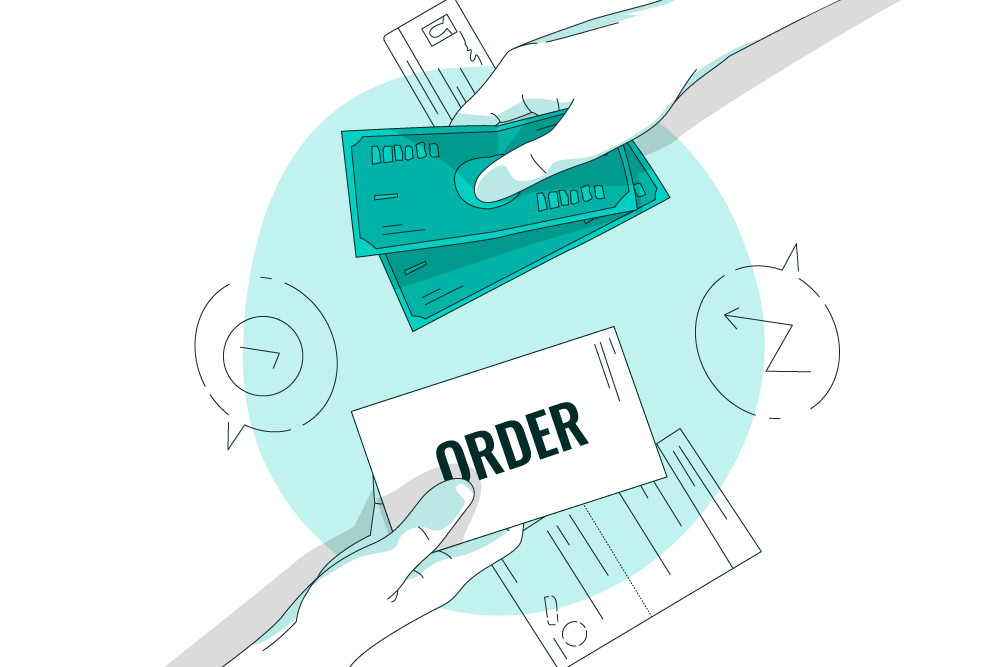

<p id="a436" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">Back then, we were just a handful of people — activists, engineers, grad students, and retail investors — who felt jaded by the system. We felt like we were being used by other investing platforms. When multiple platforms <a class="au lj" href="https://www.theverge.com/2021/2/1/22254656/robinhood-gamestop-stonks-trade-freeze-class-action-lawsuits" target="_blank" rel="noopener ugc nofollow">paused trades during the GameStop saga</a>, it seemed like the system was rigged. When we learned that companies were profiting off <a class="au lj" href="https://www.protocol.com/fintech/payment-for-order-flow-explained" target="_blank" rel="noopener ugc nofollow">payment for order flow</a> and securities lending, it seemed like we were being bought and sold. We wanted an investing platform where the cards weren’t stacked against us.</p>

<p id="64ed" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">So, we built our own.</p>

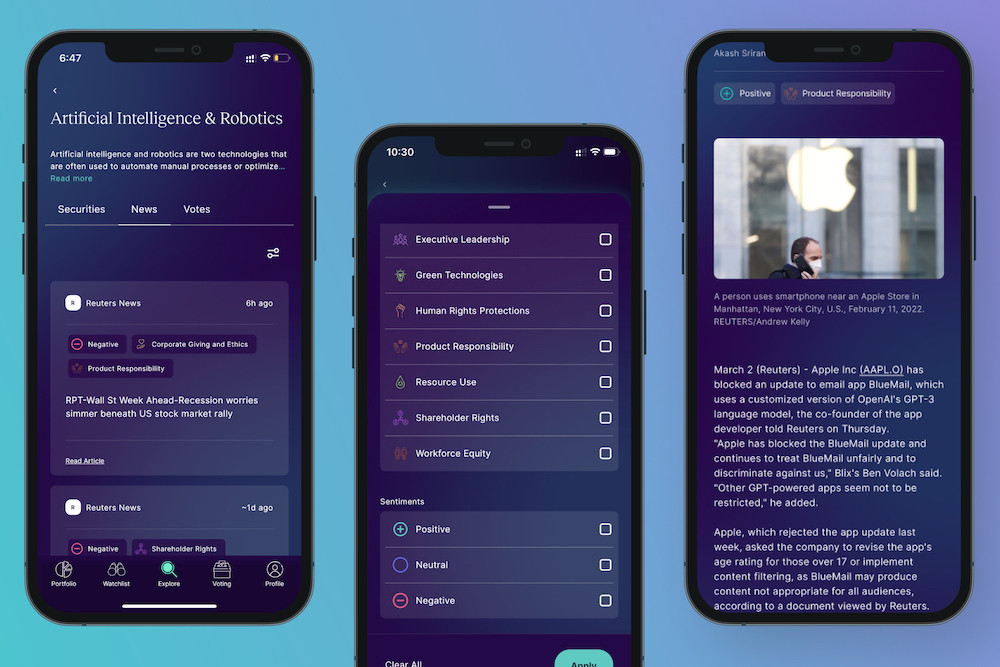

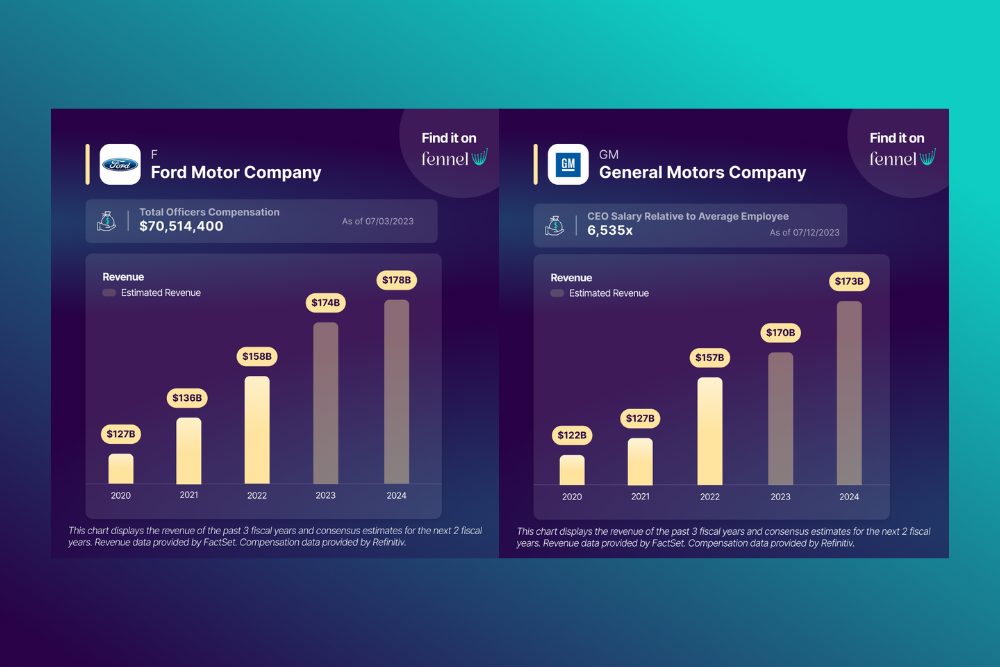

<p id="bb58" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">We designed an investing app that we’d actually want to use. One where you can invest in stocks and ETFs, know more about a company’s impact on the world, and have a say in the companies you invest in.</p>

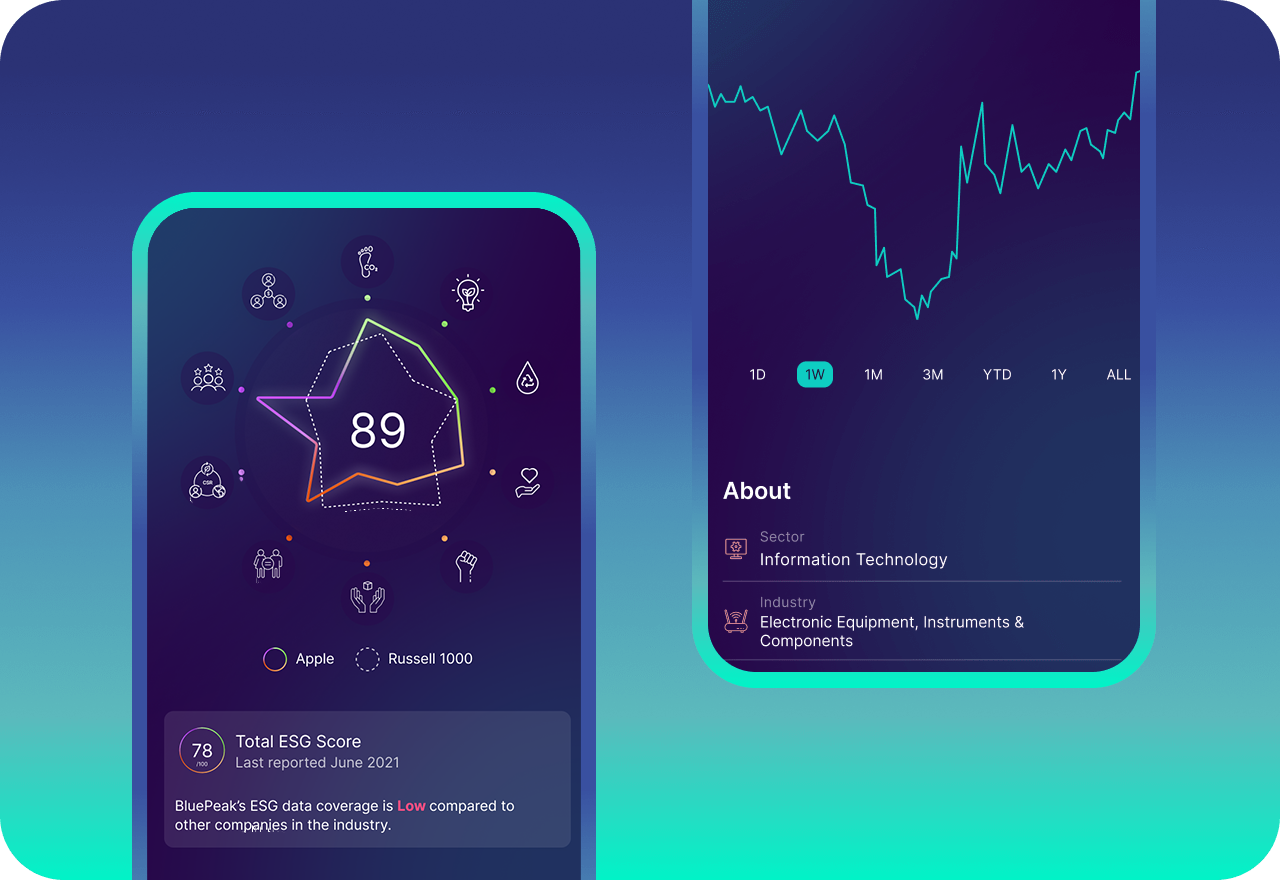

<p id="5d8f" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">We wanted to discover companies that care about the same things that we do — whether that’s a diverse workforce, renewable energy usage, or human rights protections — and, from there, decide whether or not to invest in them. So we integrated Environmental, Social, and Governance (ESG) tools to help people understand a company’s impact and its corporate structure.</p>

<p id="de3b" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">On top of that, we wanted to highlight shareholder voting as a direct line for retail investors to lobby for meaningful change in companies. So we built a platform that shines a light on past and upcoming shareholder votes.</p>

<p id="a74f" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">This way, <em class="lk">we</em>, as shareholders, can advocate for everyone who has a stake in the game — from workers, to investors, to the rest of our global community.</p>

<h4 class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc">What's at stake</h4>

<p id="95c6" class="pw-post-body-paragraph kl km ja kn b ko mg kq kr ks mh ku kv kw mi ky kz la mj lc ld le mk lg lh li it gc" data-selectable-paragraph="">Companies often take shortcuts in order to maximize profits. There are many examples of large companies that have built their supply chain on <a class="au lj" href="https://www.nytimes.com/2019/12/16/business/fashion-nova-underpaid-workers.html" target="_blank" rel="noopener ugc nofollow">unethical working conditions</a>, dumped <a class="au lj" href="https://www.newyorker.com/news/news-desk/a-whistle-blower-accuses-the-kochs-of-poisoning-an-arkansas-town" target="_blank" rel="noopener ugc nofollow">toxic chemicals into the environment</a>, or knowingly <a class="au lj" href="https://www.npr.org/2014/03/31/297312252/the-long-road-to-gms-ignition-switch-recall" target="_blank" rel="noopener ugc nofollow">sold dangerous products</a>. They may not do these things explicitly to hurt people — but people end up hurt.</p>

<p id="2c24" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">The government can intervene through laws to hold companies accountable for these actions. But regulation is a slow process and often happens after the damage is already done. We need additional ways to hold companies accountable — that’s where shareholder voting comes in.</p>

<p id="513f" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">Shareholder voting enables us to raise concerns to company leadership and engage them in conversations about what matters to us.</p>

<p id="0139" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">Owning shares of a publicly traded company can allow you to vote on important company decisions during annual shareholder meetings. These votes help companies determine things like board appointments and internal audits. But they can also help companies make decisions that directly affect us.</p>

<p id="7030" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">For example, shareholders can vote on whether a company should:</p>

<ul class="">

<li id="c378" class="ml mm ja kn b ko kp ks kt kw mn la mo le mp li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/789019/000119312521298757/d189481ddef14a.htm#toc189481_35" target="_blank" rel="noopener ugc nofollow">Report on gender and racial pay gaps</a></li>

<li id="95d5" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1754301/000119312521276133/d181730ddef14a.htm#rom181730_41" target="_blank" rel="noopener ugc nofollow">Disclose money spent on political lobbying</a></li>

<li id="47f9" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1467858/000119312521143594/d22375ddef14a.htm#rom22375_40" target="_blank" rel="noopener ugc nofollow">Tie executive compensation to greenhouse gas reduction</a></li>

<li id="4bc5" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1652044/000130817921000256/lgoog2021_def14a.htm#lgooga056" target="_blank" rel="noopener ugc nofollow">Add civil rights leaders to the board of directors</a></li>

<li id="992d" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1166691/000120677421001222/cmcsa3829211-def14a.htm#d382921a021" target="_blank" rel="noopener ugc nofollow">Report failed sexual harassment interventions</a></li>

<li id="09d1" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1326801/000132680121000022/facebook2021definitiveprox.htm#ic3434e614c6d4661abc9f5e608f438ab_58" target="_blank" rel="noopener ugc nofollow">Hold itself accountable for online child exploitation</a></li>

<li id="d54d" class="ml mm ja kn b ko mu ks mv kw mw la mx le my li mq mr ms mt gc" data-selectable-paragraph=""><a class="au lj" href="https://www.sec.gov/Archives/edgar/data/1090727/000120677421000883/ups3861781-def14a.htm#d386178a053" target="_blank" rel="noopener ugc nofollow">Report on steps taken to reduce its carbon footprint</a></li>

</ul>

<p id="7bc2" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">If these examples seem specific, it’s because they are all actual proposals that were voted on in shareholder meetings last year — and not one of them passed.</p>

<p id="6e6f" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">So what gives? Don’t people care about reducing carbon emissions and promoting social equity? Of course they do. But whether or not they actually vote on these proposals is another story.</p>

<p id="aa5a" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph=""><a class="au lj" href="https://www.broadridge.com/_assets/pdf/broadridge-proxypulse-2020-review.pdf" target="_blank" rel="noopener ugc nofollow">One report</a> found that only 28% of shares held by retail investors were used to vote in 2020. Meanwhile, 92% of shares held by institutional investors were used to vote that year. This means, it’s the hedge funds, mutual funds, large banks, and financial institutions voting on these issues — not everyday people.</p>

<p id="e4ff" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">Our goal is to make it easier for more people like you and me to vote on these issues. We believe, if more people are engaging with the companies they invest in, those companies will be incentivized to act, or face backlash from their stakeholders.</p>

<p id="d721" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">That’s just the beginning. We think that this process can have a ripple effect on the ways companies address things like climate change and human rights. It’s up to all of us to hold these companies accountable.</p>

<p id="ec07" class="pw-post-body-paragraph kl km ja kn b ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh li it gc" data-selectable-paragraph="">The engaged shareholder movement is here. Will you be a part of it?</p>

Hi, We're Fennel

A year ago, we started building an investing app to bring power back to the stakeholders.

<p><span style="font-weight: 400;">20 months ago I had a simple idea: What if capital markets could change?</span></p>

<p><span style="font-weight: 400;">What if capitalism (the same system that has driven us towards infinite growth at the cost of environmental devastation, wealth inequality, exploitation of workers, marginalization of people, and a sense of deriving one’s very purpose by the value of their productivity) could be used to solve the same problems it’s created?</span></p>

<p><span style="font-weight: 400;">But I had my doubts. Maybe I was just being naive.</span></p>

<p><span style="font-weight: 400;">It was September 2020. At the time, I was living in the Bay Area. The fires in California were so bad that I couldn’t see the sun through all the smoke. I was getting my PhD in physics, trying to find dark matter with 200 of the smartest people I’ve ever met. We were trying to solve one of the universe’s biggest mysteries — but something didn’t feel right. The world around us seemed to be disintegrating. Maybe I was just getting older and my eyes were starting to focus on the reality of the world I was living in. Was discovering dark matter really the problem I wanted to spend my time on? It couldn’t be. It felt so far away. There were more pressing issues that filled me with a sense of dread, like those thick gray clouds casting gloomy shadows on what should’ve been a sunny, late summer day.</span></p>

<p><span style="font-weight: 400;">Then something interesting happened. The Governor of California announced that the state would </span><a href="https://www.cnn.com/2020/10/03/cars/california-2035-zev-mandate/index.html"><span style="font-weight: 400;">end the sale of all gas-powered cars by 2035</span></a><span style="font-weight: 400;">. Then, New Jersey </span><a href="https://www.nj.com/news/2020/10/only-electric-cars-sold-by-2035-heres-how-nj-gets-there.html"><span style="font-weight: 400;">announced</span></a><span style="font-weight: 400;"> that it too would end the sale of gas-powered cars. And then </span><a href="https://www.caranddriver.com/news/a35104768/massachusetts-ban-new-gas-cars-2035/"><span style="font-weight: 400;">Massachusetts</span></a><span style="font-weight: 400;"> made a similar pledge. It seemed like </span><a href="https://www.reuters.com/article/us-climate-change-eu-transport/eu-to-target-30-million-electric-cars-by-2030-draft-idUSKBN28E2KM"><span style="font-weight: 400;">other countries</span></a><span style="font-weight: 400;"> were aiming for the same goal too. Even China </span><a href="https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-aims-for-evs-to-account-for-50-of-all-car-sales-by-2035-60954964"><span style="font-weight: 400;">pledged</span></a><span style="font-weight: 400;"> to make electric vehicles account for 50% of all new car sales by 2035. Politicians across the world came together, and pledged to reach a seemingly impossible goal.</span></p>

<p><span style="font-weight: 400;">I asked myself, “Why now?”</span></p>

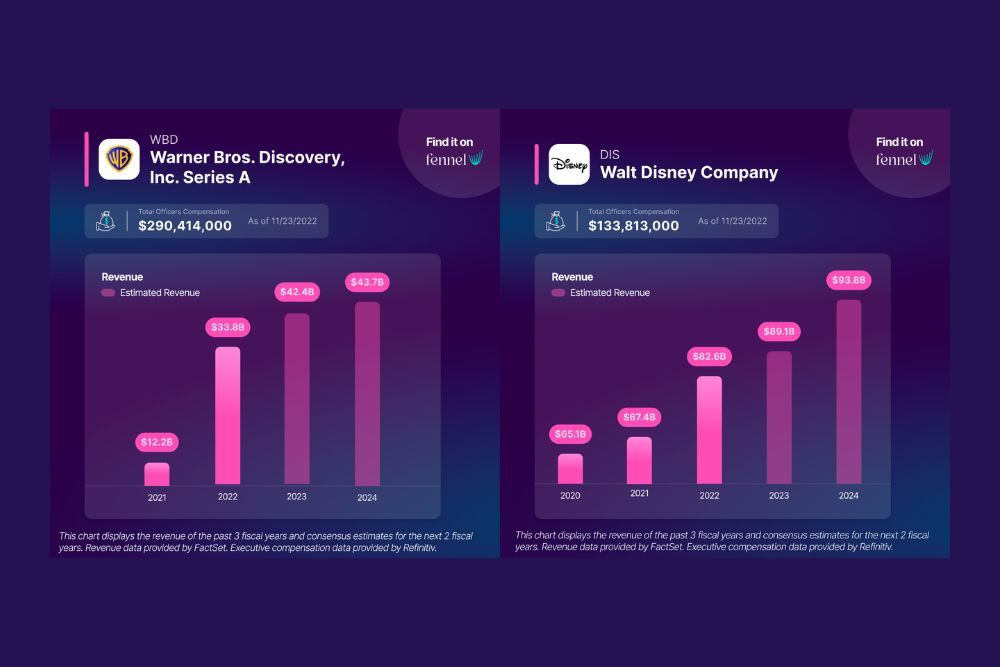

<p><span style="font-weight: 400;">Then, not long after, </span><a href="https://electrek.co/2021/02/04/ford-doubles-electric-vehicle-investment-22-billion-through-2025/"><span style="font-weight: 400;">Ford</span></a><span style="font-weight: 400;"> and </span><a href="https://www.cnbc.com/2020/11/19/gm-accelerating-ev-plans-with-additional-7-billion-announces-new-pickup.html"><span style="font-weight: 400;">GM</span></a><span style="font-weight: 400;"> both announced that they were doubling down in the EV space. It clicked. When Tesla’s valuation had skyrocketed, it sent a message to the rest of the world that something was changing. A new generation of investors didn’t care if Tesla’s business was profitable or not, they just knew that a world without EVs wouldn’t exist in 25 years. It was that simple. The concept of “value” was changing for the younger generation. What a company did for the planet mattered more than the profit it made. I thought, “Wow, wouldn’t it be great to live in a world where every companies’ mission was aligned with the values of their investors?” I wondered how we could get there.</span></p>

<p><span style="font-weight: 400;">I still had my doubts. Money was at the heart of this movement (these were for-profit businesses, after all). How could that be sustainable?</span></p>

<p><span style="font-weight: 400;">But something else happened around the same time. Investment firm Engine No. 1 </span><a href="https://www.reuters.com/article/exxon-shareholders-engine-no-1/exxon-faces-proxy-fight-launched-by-new-activist-firm-engine-no-1-idUSKBN28H1IO"><span style="font-weight: 400;">launched a bid</span></a><span style="font-weight: 400;"> to take over 4 of the 12 board seats within Exxon Mobil, with the sole intent of reducing the company’s carbon emissions. </span><a href="https://www.nytimes.com/2021/06/09/business/exxon-mobil-engine-no1-activist.html"><span style="font-weight: 400;">They succeeded</span></a><span style="font-weight: 400;">. How did they succeed? The boardroom challenge caught the attention of BlackRock, Vanguard, and State Street — some of the most powerful asset managers in the world — who all voted in favor of Engine No. 1’s board members during the Exxon meeting. These giant funds understood that there was an environmental </span><em><span style="font-weight: 400;">and</span></em><span style="font-weight: 400;"> economic risk for the continued neglect of unmonitored carbon emissions.</span></p>

<p><span style="font-weight: 400;">I went to </span><a href="https://www.proxymonitor.org/"><span style="font-weight: 400;">Proxy Monitor</span></a><span style="font-weight: 400;">, a site dedicated to tracking shareholder votes, to see all of the votes taking place besides the Exxon Mobil one. What I saw shocked me. I saw shareholders voting on things like whether </span><a href="https://www.sec.gov/Archives/edgar/data/789019/000119312521298757/d189481ddef14a.htm#toc189481_35"><span style="font-weight: 400;">Microsoft should report on its gender pay gap disparity</span></a><span style="font-weight: 400;"> or whether </span><a href="https://www.sec.gov/Archives/edgar/data/1326801/000132680121000022/facebook2021definitiveprox.htm#ic3434e614c6d4661abc9f5e608f438ab_58"><span style="font-weight: 400;">Facebook should report on the sexual exploitation of children on its platform</span></a><span style="font-weight: 400;">. These were big issues that impacted real people, but the proposals weren’t getting enough votes to pass.</span></p>

<p><span style="font-weight: 400;">Would these proposals only succeed if an activist group like Engine No. 1 was backing them? What would it take to get the big institutional firms like BlackRock and Vanguard to show support again?</span></p>

<p><span style="font-weight: 400;">I was beginning to lose hope that this would happen, that is, until a movement started among retail investors (the everyday people buying stocks as an investment in their financial future). Retail investors began entering the stock market in droves throughout 2020 for a variety of reasons, which seemed to reach a climax during </span><a href="https://www.youtube.com/watch?v=p3xj0EJ8fxk"><span style="font-weight: 400;">the GameStop short squeeze</span></a><span style="font-weight: 400;"> in early 2021. Not only were average people getting involved in capital markets like never before, these same retail investors were beginning to wise up to the system that was built around them. In the aftermath of the initial GameStop squeeze, retail investors began learning about things like payment for order flow and securities lending. They were paying attention to how hedge funds and market makers were processing their transactions. Their scrutiny even helped push these issues </span><a href="https://www.cnn.com/business/live-news/robinhood-gamestop-reddit-hearing-congress/index.html"><span style="font-weight: 400;">to the floor of congress</span></a><span style="font-weight: 400;">.</span></p>

<p><span style="font-weight: 400;">This group of retail investors — millions of people who are just like you and me — could be the ones who help push large corporations towards meaningful change. After all, it was our lives that were impacted by the decisions of these companies.</span></p>

<p><span style="font-weight: 400;">But this was just the tip of the iceberg. The more retail investors found out about the system, the more they were motivated to reform it. I was right there too. After starting my personal investing journey a few years ago, I went deeper down the rabbit hole in 2020, and even further in 2021. Eventually, I learned that my shares — and the shares of other retail investors too — could be lent out without me knowing. That’s because brokerage firms </span><a href="https://www.sonnlaw.com/faq/can-my-broker-lend-my-shares/"><span style="font-weight: 400;">are able to lend out the shares</span></a><span style="font-weight: 400;"> that their retail investors buy, if that investor signed up for a margin account and agreed to </span><a href="https://www.sec.gov/news/public-statement/staff-fully-paid-lending"><span style="font-weight: 400;">“fully-paid securities lending”</span></a><span style="font-weight: 400;"> in the terms and conditions.</span></p>

<p><span style="font-weight: 400;">This throws a major wrench in the retail investing movement, because if retail investors’ shares are lent out, they lose the ability to vote with those shares. Without the ability to vote, retail investors can’t be the voting bloc that pushes companies towards meaningful change during shareholder meetings.</span></p>

<p><span style="font-weight: 400;">I knew something had to be done. Retail investors had to band together and use the system in order to change it. It was time to create something for this world that could allow people to truly help it.</span></p>

<p><span style="font-weight: 400;">That’s what led to </span><a href="https://www.fennel.com/"><span style="font-weight: 400;">Fennel</span></a><span style="font-weight: 400;">.</span></p>

<p><span style="font-weight: 400;">Just like when I was researching dark matter, I surrounded myself with a team of intelligent people in order to tackle this mission. This time, it was a group of tech developers, financial professionals, and retail investors who felt motivated to make an impact as much as I did.</span></p>

<p><span style="font-weight: 400;">Together, we aimed to build a brokerage that had the interests of retail investors in mind. But more than that, we wanted to build a platform where people could come together and stand up for what they believe in. A place to fight for the planet, for our communities, and for the very society we all worked to build up. I hope that this platform motivates more people who align with our vision.</span></p>

<p><span style="font-weight: 400;">Join us and be part of this growing community. We hope to grow so big that our voices can no longer be ignored. Until every company truly understands the wishes of those who support them, Fennel will be there to fight alongside you.</span></p>

<p><span style="font-weight: 400;">Thank you to all of those who have joined me in this journey so far, and to all of you who have worked hard to make something truly special.</span></p>

<p> </p>

<p><span style="font-weight: 400;">See you all soon.</span></p>

<p> </p>

<p><span style="font-weight: 400;">Daniel Naim</span></p>

A Note From Our Founder

20 months ago I had a simple idea: What if capital markets could change?

<p id="a86c" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">The name “Fennel” is inspired by <a class="au li" href="https://www.worldhistory.org/Prometheus/" target="_blank" rel="noopener ugc nofollow">the ancient Greek myth of Prometheus</a>. In Greek mythology, Prometheus was one of the titans — a race of giant deities that predated the Olympian gods. When Zeus and the other Olympians fought to overthrow the primordial titans, Prometheus (whose name means “forethought”), knew that Zeus would win the war with the titans, and sided with the Olympians.</p>

<p id="9f6a" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">After fighting for 10 years, the Olympian gods did win the war, and they banished most of the titans to the depths of the underworld. However, Prometheus and his brother Epimetheus were spared. Zeus, with his newfound power, tasked Prometheus and Epimetheus with the creation of life on earth. Together the brothers created all forms of animal life, and gave each animal a unique gift. Birds were given the gift of flight. Fish were given the ability to swim. Some animals were given size and strength, others were given sharp teeth and claws.</p>

<p id="ba01" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">But when it was time to give humans their gift, Prometheus wanted them to have something special. Prometheus had handcrafted the humans out of clay, and was very fond of them. So fond that he wanted to give humans the most powerful gift he could think of — the ability to wield fire.</p>

<p id="3b03" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Prometheus snuck into the workshop of gods Hephaistos and Athena and stole their sacred fire. Prometheus then hid the flame in a hollow stalk of Fennel, and smuggled it down from Mt. Olympus to the humans on earth.</p>

<p id="22a5" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">The gift of fire was a boon to humankind. With fire, they were able to keep warm, cook their food, and forge metal weapons and tools. The gift of fire set humans apart from other animals by allowing them to harness the power of the natural world and create societies.</p>

<p id="1117" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">That fire represented the birth of technology, and with it they were able to build civilizations.</p>

<p id="5062" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">However, the gods weren’t happy when they found out about this. Zeus punished Prometheus by chaining him to a boulder, and sending an eagle to peck out his liver. Every day the eagle would feed on Prometheus’ liver, and every night it would grow back. Since Prometheus was immortal, Zeus left him to suffer this punishment for eternity.</p>

<p id="7cae" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Although Prometheus had to endure this perpetual torment from the gods, he was seen as a hero by the humans, and a martyr for his sacrifice.</p>

<p id="3abc" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">We <a class="au li" href="https://fennel.com/" target="_blank" rel="noopener ugc nofollow">named our company Fennel</a> after the fennel that Prometheus used to smuggle fire. While fire was the central focus of the story, it was fennel that functioned as a vessel for the fire. One hollow stalk of fennel contained the flame that enabled humans to build the world we know today. Without it, humans would still be in the dark.</p>

<p id="a761" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">In the myth, fire was a tool that could have benefited the masses, but access to it was limited to the powerful. This serves as an important metaphor for us. There are many different “fires” in our world today — things like education, natural resources, technology, and wealth.</p>

<p id="11e2" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">In Fennel’s case, we believe that the power of capital markets is one of those fires. Environmental, Social, and Governance (ESG) data, financial tools, and shareholder voting are all things that could be used for the greater good if they were made more accessible to everyone.</p>

<p id="0831" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">So how do you make these things more accessible? With a hollow stalk of fennel, of course. We built Fennel to make it easier to use these resources. But our platform is just one piece of technology providing access to a handful of things. There are plenty of other fires out there being guarded, and many stalks of fennel that need to be carried.</p>

<p id="28d6" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">What’s important is to keep Prometheus’ mission alive. To capture the proverbial fire and give it as a gift to all of humanity — so everyone can use it.</p>

<p id="e6bc" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Because once the fire is in your control, what to do with that power is up to you.</p>

Where Does the Name Fennel Come From?

The name "Fennel" is inspired by the ancient Greek myth of Prometheus.

<div class="is it iu iv iw">

<p id="dac6" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Modern capitalism has ushered in the greatest era of innovation, globalization, and sheer economic output in human history. However, the incentive structure, which rewards short-term gains over long-term sustainability, has come at the expense of fair labor and fair trade practices, human rights, and our planet’s delicate ecosystems. Social scientists have long recognized these shortfalls inherent to our system, but all <em class="li">external</em> efforts — government intervention, a thriving philanthropic sector, protest movements, etc. — have not done enough to curb the destruction of this capitalist machine. Even <a class="au lj" href="https://money.cnn.com/2013/09/17/news/economy/occupy-wall-street-fizzled/" target="_blank" rel="noopener ugc nofollow">Occupy Wall Street</a>, the largest anti-capitalist protest movement in modern history, failed because our corporations are ultimately beholden to no other stakeholder than their own shareholders.</p>

<p id="a37f" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">So if corporations are doing this on the behalf of their shareholders, maybe it’s up to the shareholders to help put an end to this. Shareholder activism is a channel to create impact by influencing company policy from <em class="li">within</em>. It can be a method for socially- and environmentally-conscious advocates to voice their concerns from the perspective of shareholders who want to increase the value of their ownership by promoting sustainability. As the conservationist David Brower liked to say, “There is no business to be done on a dead planet.”</p>

<p id="7c89" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Shareholder activists are bullish on <a class="au lj" href="https://www.sustain.ucla.edu/what-is-sustainability/" target="_blank" rel="noopener ugc nofollow">sustainability</a> because they realize the massive upside potential of infusing compassion into business practices: positive press, fewer boycotts, fewer fines, fewer lawsuits, fewer labor strikes, more productive employees, more consumer demand, and the benefits of increasingly-progressive legislation. Even Founder of BlackRock Larry Fink — a pro-market authority — praised shareholder activism in his <a class="au lj" href="https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter" target="_blank" rel="noopener ugc nofollow">2022 Letter to CEOs</a>. This letter, written from the perspective of the shareholders of Corporate America, did not attack capitalism but instead implored executives to reframe and repurpose capitalism to achieve a wider array of society’s ambitious goals. “Capitalism has the power to shape society and act as a powerful catalyst for change,” Fink wrote.</p>

<p id="441d" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Over the past few decades, there have been a handful of organizations that have formed in order to support sustainable action through the current capitalist system. Organizations like <a class="au lj" href="https://www.asyousow.org/" target="_blank" rel="noopener ugc nofollow">As You Sow</a>, <a class="au lj" href="https://www.greencentury.com/" target="_blank" rel="noopener ugc nofollow">Green Century Funds</a>, and <a class="au lj" href="https://impaxam.com/" target="_blank" rel="noopener ugc nofollow">Impax Asset Management</a> have used shareholder activism to put forward shareholder proposals that aim to push companies in the direction of environmental sustainability or social good.</p>

<p id="3e2e" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Why push for change through shareholder proposals? If you own stock in a company, you are entitled to vote your shares at annual shareholder meetings. Typically, shareholders vote on anything that might affect the stock price, such as the makeup of the Board of Directors, mergers & acquisitions, stock splits, and executive compensation. But many investors are also proposing measures that support ESG (Environmental, Social and Corporate Governance) initiatives, asserting <a class="au lj" href="https://online.hbs.edu/blog/post/what-is-the-triple-bottom-line#:~:text=The%20triple%20bottom%20line%20is,%3A%20profit%2C%20people%2C%20and%20the" target="_blank" rel="noopener ugc nofollow">triple bottom line</a> benefits to people, the planet, and profit. Institutional investors and activist hedge funds have leveraged shareholder activism to make great impact, such as <a class="au lj" href="https://engine1.com/" target="_blank" rel="noopener ugc nofollow">Engine №1</a> who were able to <a class="au lj" href="https://www.thedeal.com/activism/activist-investor-rankings-for-2021/" target="_blank" rel="noopener ugc nofollow">vote three environmental activists</a> onto the Board of Directors of Exxon Mobil in 2021.</p>

<p id="44d7" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Retail investors, too, can be a part of this movement. If you own stock in a publicly-traded company, you can participate in the shareholder voting process by looking up that company’s Definitive Proxy Statement, which is filed to the Securities Exchange Commission in the Schedule 14A. You may search for upcoming shareholder proposals and the proxy voting materials of your stocks through the SEC’s <a class="au lj" href="https://www.sec.gov/edgar/search/" target="_blank" rel="noopener ugc nofollow">EDGAR database</a>, which is free and open to the public.</p>

<p id="72ec" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">Disruptive technology such as investing apps have democratized access to the stock market, increasing stock trading by retail investors from diverse socioeconomic backgrounds. Thus, it is exceedingly important for retail investors not to leave their power on the table but to exercise their rights as shareholders and vote at these meetings. <a class="au lj" href="https://www.proxymonitor.org/Default.aspx" target="_blank" rel="noopener ugc nofollow">ProxyMonitor.Org</a> has a watchlist of the upcoming votes of Fortune 250 companies and allows users to sort by social impact.</p>

<p id="8739" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph="">It is famously theorized that capitalism has within it “the seeds of its own destruction.” Under a capitalist system, social classes are defined in their relation to their control over the means of production. But in the context of shareholder activism, democratized stock ownership and proxy voting allow for a more inclusive control over the means of production. Shareholder activism will allow more people to negotiate the value of corporate sustainability — a perspective that has been stifled in the past. This movement can bring about a new notion of what capitalism is and who it serves. Every vote in favor of ESG goals is another seed planted in the unemotional, hyper-rational capitalist paradigm, so that future generations can reap the benefits of a protected natural ecosystem and a compassionate corporate culture.</p>

<p class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph=""> </p>

</div>

<div class="o dy lk ll ie lm" style="padding-left: 440px;" role="separator"><strong>∙ ∙ ∙</strong></div>

<div class="is it iu iv iw">

<p id="c3c1" class="pw-post-body-paragraph kk kl iz km b kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg lh is gb" data-selectable-paragraph=""><em class="li">The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member </em><a class="au lj" href="https://www.finra.org/" target="_blank" rel="noopener ugc nofollow"><em class="li">FINRA</em></a><em class="li"> </em><a class="au lj" href="https://www.sipc.org/" target="_blank" rel="noopener ugc nofollow"><em class="li">SIPC</em></a><em class="li">.</em></p>

</div>

What's the State of Shareholder Activism?

Shareholder activism is a channel to create impact by influencing company policy from within.

<p>How many times have we followed a trend just to fit in with the “cool kids” even if meant being untrue to ourselves? The reality is, many of us have fallen prey to peer pressure at some point. But individuals aren’t the only ones who conform to a trend to stay relevant. Businesses do too, and because ESG (Environmental, Social, and Governance) and sustainability are the hot topics of today, many companies partake in something called “greenwashing.” </p>

<p> </p>

<h4><strong>Why greenwash?</strong></h4>

<p><a href="https://earth.org/what-is-greenwashing/">Greenwashing</a> is defined as the process of making misleading statements, in order to market a company or its products as being environmentally sustainable. <a href="https://corporatefinanceinstitute.com/resources/knowledge/other/greenwashing/">Some examples of greenwashing are</a>: </p>

<ul>

<li aria-level="1">Making vague or false environmental claims that are not backed up by hard evidence or third-party certifications </li>

<li aria-level="1">Placing emphasis on irrelevant issues (for example, saying a phone is “CFC-free” when CFCs are already banned by law) </li>

<li aria-level="1">Hiding “trade-offs” — essentially, highlighting small environmental victories in order to mask a larger, potentially more concerning issue (for example, banks advertising their issuing of sustainable bonds while financing companies that harm the environment) </li>

</ul>

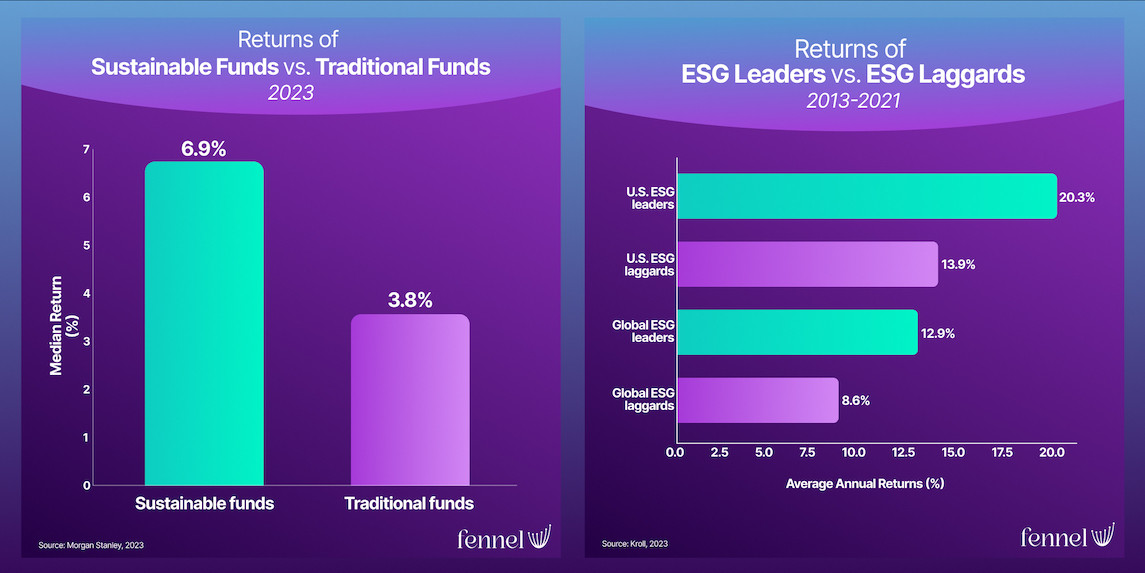

<p>Greenwashing is <a href="https://www.nasdaq.com/articles/are-companies-as-green-as-theyd-have-you-believe-2021-06-21">on the rise</a> as companies that boast of high ESG scores and sustainable practices are gaining traction in both financial and non-financial aspects. We’ve seen the S&P 500 ESG Index beat the S&P 500 Index <a href="https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-index/#overview">since the first market slump in early 2020</a>, <a href="https://www.reuters.com/business/sustainable-business/global-sustainable-bonds-see-record-issuance-jan-sept-2021-2021-10-12/">record issuance</a> of sustainable bonds in the year 2021, <a href="https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx">studies</a> that show ESG factors drive consumer preference, and customers <a href="https://www.forbes.com/sites/gregpetro/2022/03/11/consumers-demand-sustainable-products-and-shopping-formats/">willing to pay a premium to go green</a>. As a result, many companies may try to emulate this success by exaggerating how environmentally sustainable they really are.</p>

<p>Some companies resort to greenwashing as they come under pressure to comply with environmental industry standards or regulatory requirements. One such example is when <a href="https://www.bbc.com/news/business-34324772">Volkswagen admitted to cheating</a> government-required emissions tests by fitting various vehicles with “defeat devices.”</p>

<p> </p>

<h4><strong>The rewards of being truly sustainable are sustainable</strong></h4>

<p>What companies sometimes forget is that greenwashing is not sustainable (pun unintended). Those who greenwash risk getting exposed by an informed consumer or a gatekeeping group, which can backfire on the company’s reputation. A recent example would be when <a href="https://www.dezeen.com/2019/08/02/hm-norway-greenwashing-conscious-fashion-collection-news/">H&M launched its “green” clothing line called Conscious</a>. In this instance, the retailer claimed to use organic cotton and recycled polyester, but didn’t provide enough evidence to back up its marketing. The company then faced criticism for misleading claims</p>

<p>In the case that the truth behind an organization’s greenwashing claims goes uncovered, it is still at a loss as it only enjoys the superficial benefits of being a “responsible” business. It doesn’t reap the added value that actual sustainable business can receive — like <a href="https://www.bain.com/insights/sustainability-your-brands-next-cost-saving-weapon/">lower operational costs</a>, <a href="https://www.globenewswire.com/news-release/2019/01/10/1686144/0/en/CGS-Survey-Reveals-Sustainability-Is-Driving-Demand-and-Customer-Loyalty.html">loyal customers</a>, or <a href="https://www.cfachicago.org/wp-content/uploads/2020/10/Blog_-Managing-Risk-with-ESG-Investing.pdf">positive shareholder returns</a>.</p>

<p> </p>

<h4><strong>Greenwashing faces legal implications in the future</strong></h4>

<p>Most importantly, responsible ESG practices minimize regulatory and legal interventions, which in turn means less negative publicity and fines. This is exemplified in Volkswagen’s case, wherein the car manufacturer was fined $125 million for its emissions scandal, and saw further losses as a result of having to recall close to 12 million of its cars worldwide. The spiral translated into <a href="https://fortune.com/2020/10/06/volkswagen-vw-emissions-scandal-damages/">business losses</a> and <a href="https://fortune.com/2015/09/23/volkswagen-stock-drop/">negative shareholder returns</a>.</p>

<p>The greenwashing crackdown will continue with new environmental laws being written. The <a href="https://research.hktdc.com/en/article/MTAzNDU1OTc0Nw">EU has decided to amend its new consumer rules</a> to address greenwashing concerns, requiring producers to provide greater transparency on product information to avoid misleading claims. The UK is also targeting greenwashing with the Competition and Markets Authority’s <a href="https://www.whitecase.com/publications/alert/uk-clampdown-greenwashing">Green Claims Code</a>.</p>

<p>Organizations are driven towards greenwashing because of peer, consumer, or legal pressures. However, by doing so these businesses miss out on the true benefits of being sustainable.They also might expose themselves to the threat of legal action as more legislation is being drafted against greenwashing. As a result, these companies risk reputational damage, financial losses, and negative returns for stakeholders. Until regulators catch up to all the companies engaging in greenwashing, it’s up to us to be on the lookout for common greenwashing tactics, and stay fully informed about the purchases and investments we make.</p>

<p> </p>

<p style="padding-left: 440px;"><strong>∙ ∙ ∙</strong></p>

<p><em>The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member </em><a href="https://www.finra.org/"><em>FINRA</em></a><em> </em><a href="https://www.sipc.org/"><em>SIPC</em></a><em>.</em></p>

What Is Greenwashing?

Greenwashing is a superficial and sometimes misleading way companies claim sustainability.

<p><em>With financial markets around the world still reeling from muddled efforts to curb a global pandemic, one financial notion seems to be gaining fresh support: ESG. However, much about ESG remains unexplored. Are ESG and risk management practices related? How can ESG be used to benefit organizations and investors from a risk standpoint? Does one of the three ESG pillars play a bigger role in terms of generating financial returns, utility, and risk management?</em></p>

<p> </p>

<p>Some investors have a hypothesis that ESG investments generate stronger, more sustainable returns over the long term, and this has been exemplified in the past couple of years. ESG investments, indices, and companies that keep considerations of the three factors at the forefront of their culture have bounced back higher than unbothered counterparts; for example, the S&P 500 ESG Index has beat the S&P 500 Index <a href="https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-index/#overview">since the first market slump in early 2020</a>, sustainable bonds have seen <a href="https://www.reuters.com/business/sustainable-business/global-sustainable-bonds-see-record-issuance-jan-sept-2021-2021-10-12/">record issuance in the year 2021</a>, and organizations with good ESG ratings <a href="https://www.cfachicago.org/wp-content/uploads/2020/10/Blog_-Managing-Risk-with-ESG-Investing.pdf">have displayed strong financial resilience</a> since the economic downturn.</p>

<p>How can this phenomenon be explained? The answer lies in the fact that <a href="https://www2.deloitte.com/ie/en/pages/financial-services/articles/esg-risk-management-framework.html">ESG can work as a risk management strategy</a>; not just in financial terms, but also in view of management conditions and meeting regulatory requirements.</p>

<p>A <a href="https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx">report published by McKinsey</a> tells us that good ESG practices could potentially lead to positive cash flows, as well as hedge financial and reputational risks due to the following reasons:</p>

<ul>

<li>ESG drives consumer preference as some customers are <a href="https://www.forbes.com/sites/gregpetro/2022/03/11/consumers-demand-sustainable-products-and-shopping-formats/">willing to pay a premium to go green</a>. McKinsey also found that companies that use sustainable practices in their supply chain are able to cut costs.</li>

<li>Responsible reporting minimizes regulatory and legal interventions, which generates less negative publicity for an organization.</li>

<li>Having generous social policies in place helps motivate and retain staff, as well as increase employee productivity, which has been found to <a href="https://www.sciencedirect.com/science/article/abs/pii/S0304405X11000869">positively correlate with shareholder returns.</a></li>

<li>ESG practices help optimize investments and capital expenditures. One way to get ahead of the curve is to consider making investments into assets that take advantage of sustainability tailwinds. For example, China’s efforts to curb air pollution is estimated to create <a href="http://www.chinadaily.com.cn/a/201804/18/WS5ad69dc6a3105cdcf6518f2c.html">over $3 trillion in investment opportunities across various industries</a> through 2030.</li>

</ul>

<p> </p>

<h4><strong>Integrating ESG in business practices doubles as good risk management, which goes on to generate brand equity for companies and attract investors.</strong></h4>

<p>Research has <a href="https://www.mdpi.com/2071-1050/12/1/254">found a positive relationship</a> between ESG scores and brand equity value of S&P 500 companies. Good ESG incorporation mitigates reputational risks for an organization, and that is where investor confidence is built. In turn, investors manage financial risks by keeping exposures to ESG investments in their portfolios, which also helps them derive utility as they are inclined to feel that their investment decisions are part of a bigger movement to do better for the world.</p>

<p> </p>

<h4><strong>It's the Social and Governance factors that actually push away the risks.</strong></h4>

<p>We constantly hear a lot of buzz surrounding the Environmental aspect which dominates sustainable investment allocations, but the value of the Social and Governance aspects which have a determining impact on sustainable practices, and as a result, risk management within an organization, are rarely ever given recognition.</p>

<p>Taking a deep-dive into how the “S” and “G” areas are equally at play as the “E” in contributing to sound risk management within a company and yielding positive returns for investors, we delve into some research on how the three factors impact financial performance on an absolute basis.</p>

<p>A <a href="https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwi9kr_i48b3AhWTQc0KHfB2DUAQFnoECAYQAQ&url=https%3A%2F%2Fjournals.vgtu.lt%2Findex.php%2FJBEM%2Farticle%2Fdownload%2F12725%2F9980&usg=AOvVaw1dAd8rRWX31GFeB0IY3x9v">recent study</a> examined the overall and individual influences of corporate E, S, and G conduct on economic performance of S&P 500 firms. A breakdown of the scores for each aspect across companies from different industries and their correlation with the respective companies’ economic performances were looked at. The results may be surprising at first look: Corporate “E” conduct does not have any significant effect on firm economic performance, while conduct for “S” and “G” significantly influences firm economic performance.</p>

<p>The Social and Governance components are key to the general practices of risk management; aiming to do justice to these elements in the day-to-day course of running a business ensures responsible and skilled management structures, risk ownership, and compliance with regulatory requirements.</p>

<p>Here we covered reasons to explain these occurrences in the market — that ESG is an exceptional risk management tool for organizations internally, and also for investors in financial terms. More importantly, we saw that “S” and “G” are crucial to building optimal risk practices within a firm, which when combined with “E”, enhance the attractiveness of businesses and generate solid returns over the long term for investors.</p>

<p> </p>

<p><strong><u>References</u></strong></p>

<p>Ajour, E. et al. (2020). <em>The Role of Sustainability in Brand Equity Value in the Financial Sector. </em>MDPI. Retrieved April 29, 2022, from <a href="https://www.mdpi.com/2071-1050/12/1/254">https://www.mdpi.com/2071-1050/12/1/254</a></p>

<p>BNP Paribas SA Group (2021). <em>BNP Paribas recognized by EcoVadis and FTSE4Good extra-financial ratings. </em>BNP Paribas. Retrieved May 06, 2022, from https://group.bnpparibas/en/news/bnp-paribas-recognized-by-ecovadis-and-ftse4good-extra-financial-ratings</p>

<p>Cek, K. & Eyupoglu, S. (2020). <em>Does environmental, social and governance performance influence economic performance? </em>Scopus. Retrieved April 29, 2022, from <a href="https://www.scopus.com/record/display.uri?eid=2-s2.0-85087457813&origin=inward&txGid=4864f78cdc725470874f18fec147c309&featureToggles=FEATURE_NEW_DOC_DETAILS_EXPORT:1">https://www.scopus.com/record/display.uri?eid=2-s2.0-85087457813&origin=inward&txGid=4864f78cdc725470874f18fec147c309&featureToggles=FEATURE_NEW_DOC_DETAILS_EXPORT:1</a></p>

<p>Cheasty, G. (2019). <em>Asset Management: Integrating ESG Risk into a Risk Management Framework.</em> Deloitte. Retrieved April 22, 2022, from <a href="https://www2.deloitte.com/ie/en/pages/financial-services/articles/esg-risk-management-framework.html">https://www2.deloitte.com/ie/en/pages/financial-services/articles/esg-risk-management-framework.html</a></p>

<p>Dorobantu, S., Henisz, W. & Nartey, L. (2022). <em>Spinning gold: The financial returns to stakeholder engagement. </em>Wiley Online Library. Retrieved May 09, 2022, from <a href="https://onlinelibrary.wiley.com/doi/abs/10.1002/smj.2180">https://onlinelibrary.wiley.com/doi/abs/10.1002/smj.2180</a></p>

<p>Edmans, A. (2011). <em>Does the stock market fully value intangibles? Employee satisfaction and equity prices. </em>ScienceDirect. Retrieved May 09, 2022, from <a href="https://www.sciencedirect.com/science/article/abs/pii/S0304405X11000869">https://www.sciencedirect.com/science/article/abs/pii/S0304405X11000869</a><br /><br />Henisz, W., Koller, T., and Nuttall, R. (2019). <em>Five ways that ESG creates value. </em>McKinsey Quarterly. Retrieved May 09, 2022, from https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx</p>

<p>Lawrence, E., & Zlatkova, S. (2020). <em>Managing risk with ESG investing - CFA society chicago</em>. Northern Trust Asset Management. Retrieved April 26, 2022, from <a href="https://www.cfachicago.org/wp-content/uploads/2020/10/Blog_-Managing-Risk-with-ESG-Investing.pdf">https://www.cfachicago.org/wp-content/uploads/2020/10/Blog_-Managing-Risk-with-ESG-Investing.pdf</a></p>

<p>Murugaboopathy, P., & Dogra, G. (2021). <em>Global sustainable bonds see record issuance in Jan-Sept 2021</em>. Reuters. Retrieved April 26, 2022, from <a href="https://www.reuters.com/business/sustainable-business/global-sustainable-bonds-see-record-issuance-jan-sept-2021-2021-10-12/">https://www.reuters.com/business/sustainable-business/global-sustainable-bonds-see-record-issuance-jan-sept-2021-2021-10-12/</a></p>

<p>S&P Global. (2022). <em>S&P 500 ESG Index</em>. S&P Dow Jones Indices. Retrieved April 22, 2022, from <a href="https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-index/#overview">https://www.spglobal.com/spdji/en/indices/esg/sp-500-esg-index/#overview</a></p>

<p> </p>

<p style="padding-left: 440px;"><strong>∙ ∙ ∙</strong></p>

<p><em>The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member </em><a href="https://www.finra.org/"><em>FINRA</em></a><em> </em><a href="https://www.sipc.org/"><em>SIPC</em></a><em>.</em></p>

How Does ESG Relate to Risk Management?

Some investors have a hypothesis that ESG investments generate stronger, more sustainable returns over the long term.

<p id="44d3" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">I arrived at Harvard as a first-year student in the fall of 2018. I was passionate about climate justice even as an incoming freshman. So you can imagine my surprise when I found out that my own university was also a corporation actively investing in the destruction of the homes of me and my peers, and the future of our society.</p>

<p id="1cd3" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">This is not hyperbole. Harvard is governed by the <a class="au li" href="https://www.harvard.edu/about/leadership-and-governance/harvard-corporation/" target="_blank" rel="noopener ugc nofollow">Harvard Corporation</a>, which manages a $52 billion endowment fund that up until recently included holdings in the fossil fuel companies driving the climate crisis.</p>

<p id="966c" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Like me, many students enter college with little to no idea of what endowments are or just how vast a social and political impact universities have through them. Endowments are large pots of money that universities invest to generate income. They are <a class="au li" href="https://www.insidephilanthropy.com/explainers/what-is-an-endowment" target="_blank" rel="noopener ugc nofollow">set up to ensure the financial future of a university</a> and enable it to provide for generations of students, faculty, and community members to come. But when invested in fossil fuel companies, the only futures these funds safeguard effectively are those of the extractive industries wrecking our planet, as well as the vested interests behind them.</p>

<p id="3149" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Divestment, or the act of removing one’s investment, <a class="au li" href="https://www.theguardian.com/environment/2015/jun/23/a-beginners-guide-to-fossil-fuel-divestment" target="_blank" rel="noopener ugc nofollow">works</a> to change that paradigm. It helps transform endowments from instruments of corporate finance into reflections of the needs, interests, and concerns of the university and broader community. Simply put, an institution of higher education cannot realize its espoused commitments to climate action, social justice, and preparing young people to be tomorrow’s leaders while investing in a status quo that prevents this from happening.</p>

<p id="911d" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Prestigious and wealthy universities have a unique responsibility to be leaders in divestment, and some have taken steps towards doing so. Harvard finally <a class="au li" href="https://www.thenation.com/article/activism/harvard-fossil-fuel-divestment-won/" target="_blank" rel="noopener ugc nofollow">moved</a> to divest in fall 2021 after years of tireless student organizing and massive public pressure. But other well-known universities, <a class="au li" href="https://www.washingtonpost.com/education/2022/02/16/college-fossil-fuel-divest-legal-action/" target="_blank" rel="noopener ugc nofollow">like Stanford</a>, have yet to divest.</p>

<p id="b58c" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Fossil fuel investments and other ties to the fossil fuel industry also <a class="au li" href="https://www.teenvogue.com/story/fossil-fuel-divest-harvard-complaint" target="_blank" rel="noopener ugc nofollow">create</a> an inherent conflict of interest that <a class="au li" href="https://www.project-syndicate.org/commentary/institutional-investors-must-divest-from-fossil-fuels-by-bevis-longstreth-1-and-connor-chung-2021-11" target="_blank" rel="noopener ugc nofollow">jeopardizes</a> universities’ core academic and <a class="au li" href="https://fossilfreeresearch.com/" target="_blank" rel="noopener ugc nofollow">research missions</a>. Consider, for instance, how many universities continue to <a class="au li" href="http://www.unkochmycampus.org/rsc-report" target="_blank" rel="noopener ugc nofollow">accept</a> <a class="au li" href="https://www.theguardian.com/education/2021/dec/11/uk-universities-took-89m-from-oil-firms-in-last-four-years" target="_blank" rel="noopener ugc nofollow">vast sums</a> of fossil fuel <a class="au li" href="https://tinyurl.com/fossilfuelties" target="_blank" rel="noopener ugc nofollow">funding</a> for climate change-related research, despite a <a class="au li" href="https://pubmed.ncbi.nlm.nih.gov/9605902/" target="_blank" rel="noopener ugc nofollow">well-documented</a> <a class="au li" href="https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6187765/" target="_blank" rel="noopener ugc nofollow">pattern</a> of <a class="au li" href="https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1360-0443.1997.tb02863.x#references-section" target="_blank" rel="noopener ugc nofollow">distorted</a> research outcomes resulting from funding by companies with an oppositional agenda. <a class="au li" href="https://www.ft.com/content/16091645-98b3-4041-9ca2-053fb60181ba" target="_blank" rel="noopener ugc nofollow">No</a> major fossil fuel company is <a class="au li" href="https://priceofoil.org/2020/09/23/big-oil-reality-check/" target="_blank" rel="noopener ugc nofollow">truly aligned</a> with the demands of climate science or justice. Many continue to launch concerted campaigns <a class="au li" href="https://www.climatechangecommunication.org/america-misled/" target="_blank" rel="noopener ugc nofollow">spreading</a> climate misinformation and <a class="au li" href="https://unearthed.greenpeace.org/2021/06/30/exxon-climate-change-undercover/" target="_blank" rel="noopener ugc nofollow">opposing</a> climate action. So it is clear that the industry cannot be a trustworthy partner in the production of public knowledge and ultimately, policy, on climate. By <a class="au li" href="https://www.latimes.com/opinion/story/2022-04-03/climate-change-research-funding-fossil-fuels" target="_blank" rel="noopener ugc nofollow">allowing</a> fossil fuel companies to use their credibility — whether through investments that sustain these companies’ core business model or research partnerships that <a class="au li" href="https://www.thenation.com/article/environment/university-climate-research-fossil-fuels/" target="_blank" rel="noopener ugc nofollow">bolster</a> their <a class="au li" href="https://www.theguardian.com/environment/2022/feb/16/oil-firms-climate-claims-are-greenwashing-study-concludes" target="_blank" rel="noopener ugc nofollow">greenwashing</a> — universities make themselves complicit in climate breakdown and <a class="au li" href="https://www.timeshighereducation.com/blog/fossil-fuel-research-ties-undermine-universities-climate-change-response" target="_blank" rel="noopener ugc nofollow">undermine</a> their own potential for urgently-needed climate leadership.</p>

<p id="3b5a" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Already, asset managers controlling nearly <a class="au li" href="https://www.stand.earth/advisory/divestment-40-trillion" target="_blank" rel="noopener ugc nofollow">$40 trillion</a> worth of funds have pledged to divest from fossil fuels because they recognize the need to align their financial practices with their principles. They also recognize the overwhelming <a class="au li" href="https://ieefa.org/major-investment-advisors-blackrock-and-meketa-provide-a-fiduciary-path-through-the-energy-transition/" target="_blank" rel="noopener ugc nofollow">evidence</a> that divestment <a class="au li" href="https://www.nytimes.com/2021/10/26/opinion/climate-change-divestment-fossil-fuels.html" target="_blank" rel="noopener ugc nofollow">works</a>. And they know that without taking a bold stance against fossil fuels and other industries undermining our sustainable future, they’ll lose the chance to have young people like myself as potential customers, employees, supporters, and so on. Regardless of the reason, the choice to divest must be applauded. But to truly lead on climate, institutions like Harvard must take the next step of severing remaining fossil fuel industry ties, by doing things like banning fossil fuel research money and recruitment on campus, or <a class="au li" href="https://www.thenation.com/article/environment/harvard-yale-fossil-fuel-divestment/" target="_blank" rel="noopener ugc nofollow">reinvesting</a> in community-based and renewable energy solutions.</p>

<p id="0bbe" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Still, some asset managers and fund trustees (unsurprisingly, some with <a class="au li" href="https://yaledailynews.com/blog/2022/02/24/four-yale-trustees-accused-of-conflict-of-interest-for-fossil-fuel-ties/" target="_blank" rel="noopener ugc nofollow">personal</a> <a class="au li" href="http://harvardcorplovesfossilfuels.divestharvard.com/" target="_blank" rel="noopener ugc nofollow">ties</a> to the fossil fuel industry) continue to make the same tired and bad faith arguments about the value of engaging with the fossil fuel industry as shareholders. We know that such engagement <a class="au li" href="https://impakter.com/harvard-from-apartheid-to-the-climate-crisis-the-limits-of-shareholder-engagement/" target="_blank" rel="noopener ugc nofollow">does not</a> <a class="au li" href="https://www.commondreams.org/views/2021/11/22/shareholder-engagement-fossil-fuel-companies-failure-climate-change" target="_blank" rel="noopener ugc nofollow">work</a> when the core business model is the problem. And it cannot work when the fossil fuel industry makes it <a class="au li" href="https://www.newsweek.com/fossil-fuel-companies-are-undermining-our-future-opinion-1609813" target="_blank" rel="noopener ugc nofollow">abundantly clear</a> that it’s unwilling to let this model go so long as any potential profit remains — no matter the cost to the environment or human life. That is why young people must continue leading the way in calling for total divestment. It is not <em class="lh">an option</em> but the <em class="lh">only option</em> for moneyed institutions to play a positive role in combating climate change.</p>

<p id="02bd" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph="">Actions and dollars, too, speak louder than words. Ending fossil fuel finance and other forms of social license-giving to the fossil fuel industry is vital for remaking our energy and economic systems in favor of people and the planet. The case is as strong as ever: with Russia’s war on Ukraine <a class="au li" href="https://www.newyorker.com/news/daily-comment/this-earth-day-we-could-be-helping-the-environment-and-ukraine" target="_blank" rel="noopener ugc nofollow">making</a> the instability of a global fossil fuel economy uniquely clear, we need to push our institutions to be champions of this remaking, instead of dragging their heels.</p>

<p class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph=""> </p>

<p class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" style="padding-left: 440px;" data-selectable-paragraph=""><strong>∙ ∙ ∙</strong></p>

<div class="ir is it iu iv">

<p id="48f3" class="pw-post-body-paragraph kj kk iy kl b km kn ko kp kq kr ks kt ku kv kw kx ky kz la lb lc ld le lf lg ir ga" data-selectable-paragraph=""><em class="lh">The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member </em><a class="au li" href="https://www.finra.org/" target="_blank" rel="noopener ugc nofollow"><em class="lh">FINRA</em></a><em class="lh"> </em><a class="au li" href="https://www.sipc.org/" target="_blank" rel="noopener ugc nofollow"><em class="lh">SIPC</em></a><em class="lh">.</em></p>

</div>

Why Are Students Pushing Universities To Divest?

Some universities are using endowment funds to invest in the oil industry.

<p><em><span style="font-weight: 400;">Fennel is joining forces with We The Investors to provide engaging educational content to help retail investors learn more about capital markets. This introduction is the first post in an ongoing series.</span></em></p>

<p> </p>

<p><span style="font-weight: 400;">The main reason we launched Fennel was to ensure that we, as retail investors, are represented in capital markets. As a result, we pay close attention to other groups advocating for the same ideals, which is how we learned of </span><a href="https://www.urvin.finance/advocacy"><span style="font-weight: 400;">We The Investors</span></a><span style="font-weight: 400;"> (WTI), a grassroots organization pushing for market reforms on the behalf of retail investors.</span></p>

<p><span style="font-weight: 400;">Earlier this year, WTI </span><a href="https://www.urvin.finance/advocacy/we-the-investors-pfof-sign-on"><span style="font-weight: 400;">wrote a letter</span></a><span style="font-weight: 400;"> to the SEC asking the agency to address payment for order flow (PFOF) and excessive off-exchange trading. Both of these practices are legal in the US, but their questionable ethics have </span><a href="https://www.bloomberg.com/news/articles/2022-06-08/sec-chief-takes-aim-at-payment-for-order-flow-in-sweeping-plans#xj4y7vzkg"><span style="font-weight: 400;">led to increased scrutiny</span></a><span style="font-weight: 400;"> by regulators.</span></p>

<p><span style="font-weight: 400;">Many of us at Fennel signed WTI’s SEC letter, along with more than 71,000 other retail investors. Inspired by this action, we reached out to two of WTI’s founders, Dave Lauer and Alex Cohen, to learn more.</span></p>

<p><span style="font-weight: 400;">“In the world of social media, the largest companies in history have attained their size by productizing their users. They pitted their interests against the interests of their users, through selling user data and exploiting their market power. I think we see a lot of the same things in capital markets,” We The Investors co-founder Dave Lauer told Fennel.</span></p>

<p><span style="font-weight: 400;">He continued, “People need to think about [payment for order flow] like they do with big tech. If you’re paying for a tech service with your privacy, you might think that’s not an explicit cost, but it very much is. It’s just like payment for order flow. You might think you're getting free trading because there's no explicit cost. But implicit costs can add up to be even more than the explicit costs you’d pay otherwise.”</span></p>

<p><span style="font-weight: 400;">This stance and the support it received has helped WTI </span><a href="https://twitter.com/UrvinTerminal/status/1534927667761491974"><span style="font-weight: 400;">get meetings</span></a><span style="font-weight: 400;"> with the SEC chairman Gary Gensler, and allowed them to advocate for change </span><a href="https://twitter.com/UrvinTerminal/status/1539230563659239424"><span style="font-weight: 400;">in front of Congress</span></a><span style="font-weight: 400;">. But this is just one initiative spearheaded by the group.</span></p>

<p><span style="font-weight: 400;">We The Investors aims to help individual investors learn about how structural issues with capital markets affect their daily lives. Through this education, the group encourages investors to push for reform in order to create fairer markets. Lauer and Cohen are also co-founders of </span><a href="https://www.urvin.finance/"><span style="font-weight: 400;">Urvin Finance</span></a><span style="font-weight: 400;">, a startup that is building a market data platform called </span><a href="https://www.urvin.finance/mission"><span style="font-weight: 400;">The Terminal</span></a><span style="font-weight: 400;">, which aims to give individual investors professional-quality data analytics, educational resources, and tools.</span></p>

<p><span style="font-weight: 400;">“I think the answer to a lot of problems in markets is more transparency. That's always been a guiding principle of the reforms I've been pushing for,” Lauer explained. “As a capitalist, I believe in transparency and competition. I think if you put everyone on a level playing field and open things up, that tends to give you the best outcomes.”</span><span style="font-weight: 400;"> </span></p>

<p><span style="font-weight: 400;">WTI has put together an </span><a href="https://www.urvin.finance/advocacy#preamble1"><span style="font-weight: 400;">Investor Bill of Rights</span></a><span style="font-weight: 400;"> with several guiding principles to organize its advocacy efforts and directions for possible reform. The principles include:</span></p>

<pre> </pre>

<ul>

<li aria-level="1"><strong>Transparency:</strong> Investors should be able to gather all important information regarding their brokers’ practices, including costs, how their securities are held, and more</li>

</ul>

<pre> </pre>

<ul>

<li aria-level="1"><strong>Simplicity & Fairness:</strong> Markets should be easier to understand and trust, without unnecessary complexity and excessive intermediation.</li>

</ul>

<pre> </pre>

<ul>

<li aria-level="1"><strong>Choice & Control:</strong> Investors should have control over their orders, trades, accounts and investments.</li>

</ul>

<pre> </pre>

<ul>

<li aria-level="1"><strong>Best Execution:</strong> Brokers must be held to a true best execution standard, not a “good enough” standard. Conflicts-of-interest must be fully disclosed or eliminated.</li>

</ul>

<pre> </pre>

<ul>

<li aria-level="1"><strong>Better Settlement & Clearing:</strong> Investors should be offered a choice about how their purchase orders are settled. Barriers that affect an investor’s choice should be removed.</li>

</ul>

<pre> </pre>

<p><span style="font-weight: 400;">These five principles are meant as guidelines to make markets fairer, and WTI identifies different issues that need to be addressed in order to push for each one. The organization also helps walk retail investors through the process of how they too can help, like sending their own letters to the SEC or members of Congress.</span></p>

<p><span style="font-weight: 400;">Reaching out to government representatives is one way to advocate for systemic change, but it can also be intimidating if you’ve never done it before. That’s why WTI walks people through the process, with </span><a href="https://www.urvin.finance/advocacy-issues/comment-letters"><span style="font-weight: 400;">a guide on how to write an SEC comment letter</span></a><span style="font-weight: 400;"> and </span><a href="https://vimeo.com/683960170?embedded=true&source=video_title&owner=168392146"><span style="font-weight: 400;">a helpful video</span></a><span style="font-weight: 400;">. The SEC is required by law to read these comment letters, which is why WTI encourages people to write them.</span></p>

<p><span style="font-weight: 400;">WTI’s resources are valuable assets for investors who want fairer markets, and for those who want to get directly involved in reform. As Lauer puts it, “Let's just get the right information into people's hands so that they can make good decisions.”</span></p>