Back to Learn page

Back to Learn page

The Kaiser Permanente Deal is the Next Bellwether in America’s Labor Movements

After a three day strike in early October, workers for healthcare consortium Kaiser Permanente successfully negotiated an agreement to improve working conditions. The strike involved 75,000 workers across more than a dozen hospitals and resulted in a tentative agreement that includes a 21% raise over four years and significant improvements in worker benefits.This deal with Kaiser Permanente’s workforce marks another recently concluded strike amidst a wave of labor movements in the US.

Why did this strike work out so well, while strikes by other labor groups still drag on? The Guardian highlighted the "unified action from the rank and file and their willingness to strike" which created substantial leverage in negotiations.

CNN reports that "there have been 196 strikes lasting a week or less this year, an 86% increase compared to the same period in 2021." This may serve as an indication that companies are quickly recognizing the value of their workers — or it may indicate a financial inability to sustain business while a strike continues. In the case of a healthcare giant like Kaiser Permanente, the sector may simply not be able to afford a shutdown, making it especially vulnerable to labor disruptions.

These dynamics introduce an element of risk and uncertainty, especially for those invested in healthcare stocks. Short strikes, although less damaging to workers, can incur premium costs for companies forced to bring in temporary staff or compensate for service interruptions. Moreover, companies like Kaiser Permanente, a significant player in the private healthcare sector, could set a precedent for others. In a sector representing a significant part of the U.S. economy, a rise in short strikes could lead to broader financial repercussions.

Yet, it's not just about risk aversion. Companies that successfully navigate these challenges could emerge as resilient investment options. Those that strike a harmonious balance between operational efficiency and worker satisfaction may see longer-term benefits, including a stable workforce and an enhanced corporate reputation.

The Kaiser Permanente strikes and the rising trend of short, disruptive strikes demand careful consideration from retail investors. The landscape is shifting, and understanding these labor dynamics is crucial for investors seeking a balanced portfolio that accounts for both ethical considerations and financial performance.

Three Questions for Retail Investors to Consider:

∙ Do the companies in your portfolio have a history of labor unrest, and how have they navigated past strikes?

∙ Are you adequately diversified to absorb potential stock valuation fluctuations due to increased labor movements, particularly short strikes?

∙ How are companies in your portfolio, especially those in sectors like healthcare, addressing the increasing demands for worker benefits and fair wages?

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Intrapreneurs create innovation from within their company.

What does impact investing look like in practice?

Social impact doesn't always happen in a vaccum.

Corporate Social Responsibility is a hot topic nowadays, but how does it actually benefit companies?

Want to invest in bonds while having a positive impact on the world?

The Tax Cuts and Jobs Act of 2017 helped create a new type of impact investing.

Equity crowdfunding allows more people to participate in early stage startup investing.

A growing number of future business leaders are learning about sustainability in their MBA programs.

The 17 SDGs represent aspirational goals that span a range of economic and societal issues, with the intention of providing a better future for all.

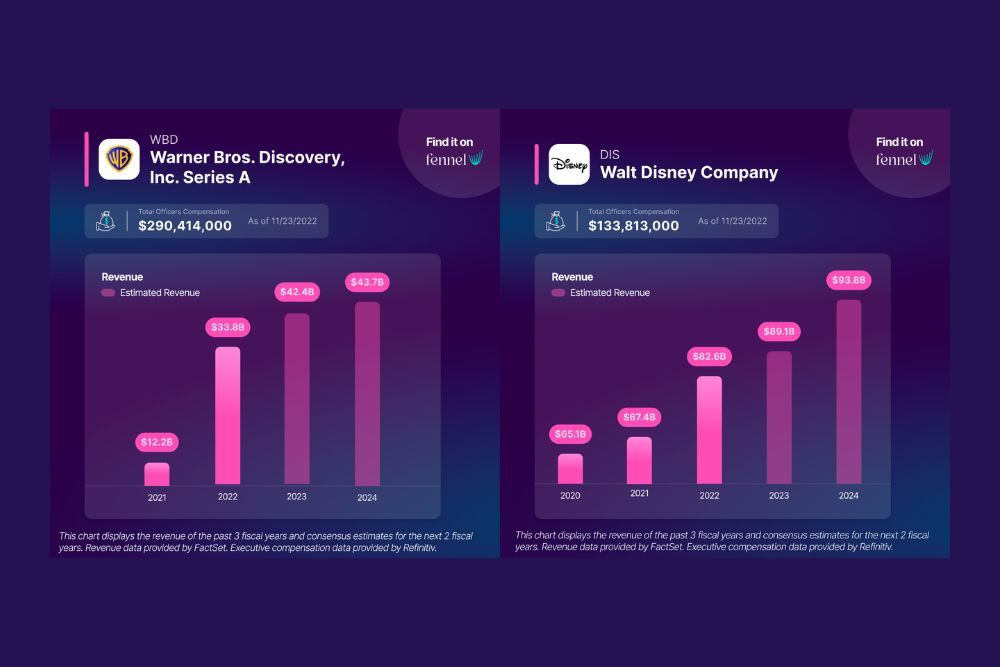

Does it make more financial sense for studios to meet the writers’ and actors’ demands, or not?

Take back the power of your investment