Back to Learn page

Back to Learn page

How People and Businesses Strive to Create Social Impact

In today’s tech-focused world, it seems like people’s actions are constantly scrutinized. With this level of self-awareness people often wonder, “Am I doing the right thing?”

With existential threats like climate change and social inequality, there is pressure on the individual to contribute back to society, and to speak up for social issues. We eat less meat, take shorter showers, and turn up the thermostat to address our environmental impact. We also watch what we say on social media to address our social impact. Though sometimes we find ourselves (fairly) asking the following question — how do we even know our actions are helping the world around us? Is there any way to quantify the impact of our prudent practices?

People aren’t the only ones asking themselves these questions. Many businesses and organizations strive to do the right thing, and look for the right tools to measure their impact. This is especially important because the scale of certain businesses can lead to much greater impacts than the actions taken by individuals.

Before we get into the details of this, let’s first understand what “social impact” actually means. Social impact can be defined as the effect of an organization or individual’s actions that brings upon a value-adding change in a community, as a result of attempting to address a social challenge (things like systemic hunger, poverty, or inequality linked to certain demographics). However, it is important to note that pushing for positive change doesn’t always happen in a vacuum. For example, a government pushing to create more jobs for its people can end up causing adverse environmental impacts if it ends up giving grants to companies that do not carry out their business practices in a sustainable manner.

As individuals, one way to make informed decisions that create social impact is by opting for products of companies that operate and manage their supply chain in a responsible manner. Many consumers already abide by this, as a recent survey found that 90% of millennials are likely to buy products from brands with a “cause” when choosing between two brands of equal quality and price. This shows incentive for businesses to align themselves with such causes.

It’s relatively easy for us as individuals to make “greener” shopping decisions in order to support sustainable brands. But individuals can take their support a level further through socially responsible investing, which involves investing in companies that work to create positive social or environmental impacts.

A survey of DIY traders and investors published by Capital.com found that more than half of the respondents had never selected an investment based on environmental, social, and governance (ESG) criteria, with only 7% citing social and environmental reasons as part of their investment strategy. This shows that socially responsible and ESG investing has yet to really take off, potentially showing opportunity for growth.

People know that they want to do good, and mission-driven businesses mirror this desire. However, there is still much to be done. Luckily, there are steps that both groups can take in order to create a positive impact. And as long as people work towards these goals, they can hope to make a difference.

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Employing ESG strategies may not result in favorable investment performance. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Intrapreneurs create innovation from within their company.

What does impact investing look like in practice?

Corporate Social Responsibility is a hot topic nowadays, but how does it actually benefit companies?

Want to invest in bonds while having a positive impact on the world?

The Tax Cuts and Jobs Act of 2017 helped create a new type of impact investing.

Equity crowdfunding allows more people to participate in early stage startup investing.

A growing number of future business leaders are learning about sustainability in their MBA programs.

The 17 SDGs represent aspirational goals that span a range of economic and societal issues, with the intention of providing a better future for all.

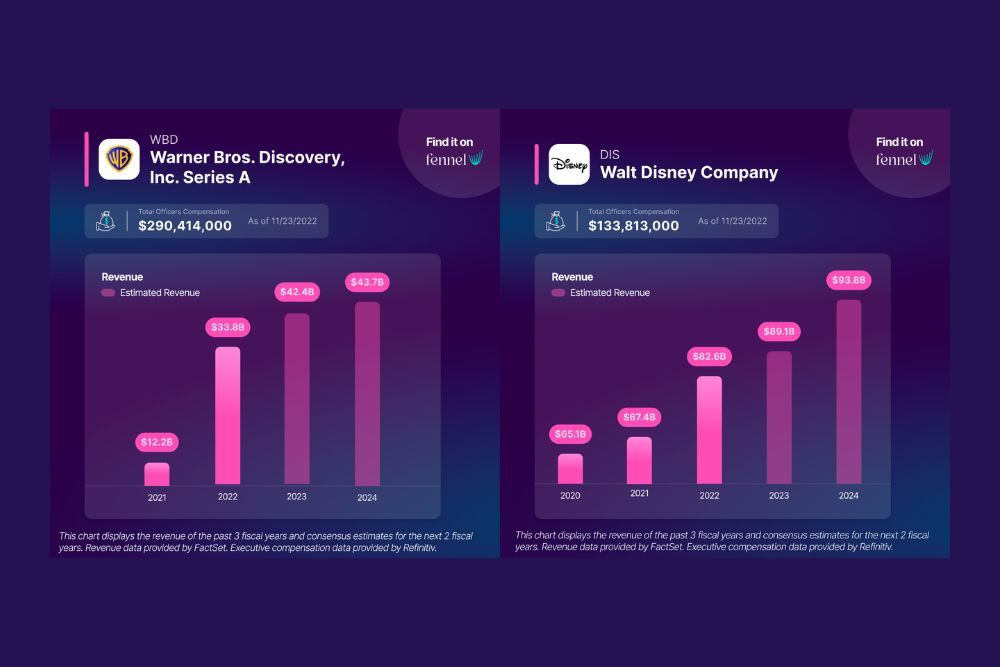

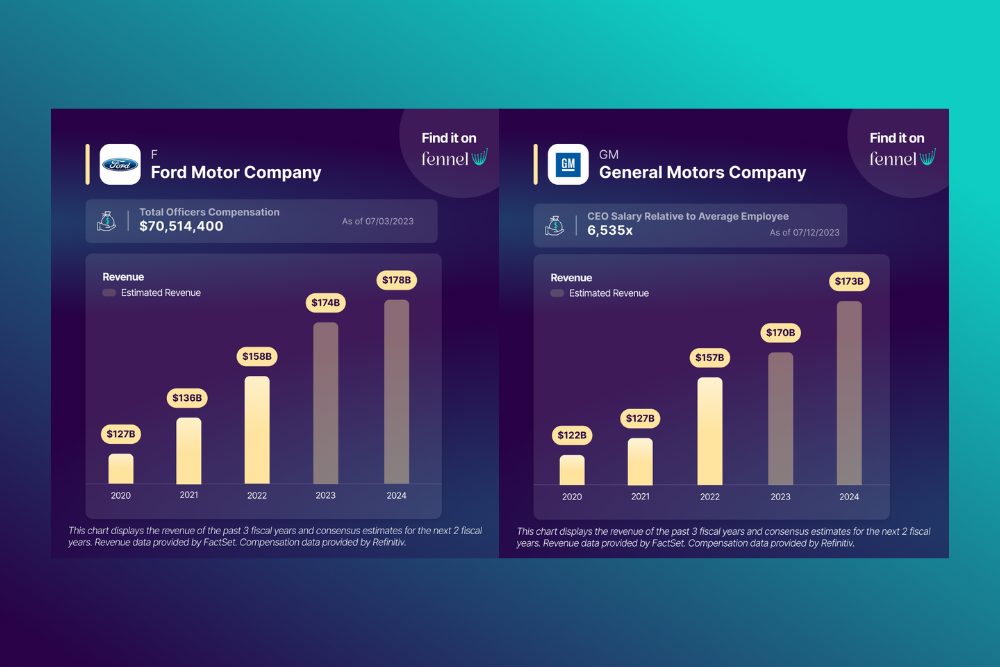

Does it make more financial sense for studios to meet the writers’ and actors’ demands, or not?

Fair pay is one the main issues of the strike, as CEO pay has increased in recent decades while workers’ adjusted wages have decreased.

Take back the power of your investment