Back to Learn page

Back to Learn page

Opportunity Zones Incentivize Impact Investing Through Tax Benefits

Tax cuts are often criticized for helping the rich more than the poor, and further increasing wealth and income inequality in America. The Tax Cuts and Jobs Act of 2017 (TCJA) faced these same criticisms.

A 2021 study found that needy families received the least savings as a proportion to their income, while wealthy families received the most. Corporations, on the other hand, were by far the biggest winners from these tax cuts, according to that study. An analysis by the Brookings Institute found that the TCJA also led to a budget shortfall for the federal government, which can hinder the government’s ability to provide important economic programs for millions of struggling Americans.

When the TCJA passed, most of the media focused on these tax cuts, however, the new law also had one provision that flew under the radar: the creation of Opportunity Zones.

The “Qualified Opportunity Zone” designation is a label that local governors give to economically-distressed areas, in order to get investors to invest in that community. They incentivize investors to do this by giving them the tax benefit of deferring their capital gains taxes. Opportunity Zones could provide socially-conscious investors with a new avenue to create impact, and may prove to be a silver lining to what critics feel was an out-of-touch policy in TCJA. However, the true potential is yet to be seen.

After TCJA passed, state and local governments were tasked with designating which low-income communities would become Opportunity Zones based on US Census data. Many local governments strategically selected their Opportunity Zones to overlap with other census-tract-based economic development programs like New Market Tax Credits, a program which also attracts private capital to distressed communities.

How does one invest in an Opportunity Zone?

Numerous Qualified Opportunity Funds (QOF) were set up in order to help facilitate investments in small businesses and real estate developments located within these Opportunity Zones. (You check out a database of Qualified Opportunity Funds here).

But these funds have a few rules. All investments in either small businesses or property developments must be equity-based. Real estate developments must include substantial rehabilitation — a Qualified Opportunity Fund cannot simply buy up distressed properties and leave them as such, they have to improve these areas. “Sin businesses,” such as liquor and tobacco stores are not eligible investments.

These rules are partially why many Qualified Opportunity Funds opt to invest in real estate over small businesses, despite the fact that investing in small businesses has the potential to create a larger impact in economically-distressed areas by providing services and jobs.

Regardless, there is still an opportunity to drive impact. So how do investors get involved? Remember, the Opportunity Zone designation has tax benefits for capital gains, so an investor who wants to get those benefits can transfer recent capital gains proceeds into a Qualified Opportunity Fund.

According to the IRS, this is the tax benefit of doing so:

“If the investor holds the investment in the QOF for at least 10 years, the investor is eligible to elect to adjust the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged.”

That may be a little complicated to decipher, but it essentially means that investors who hold their Opportunity Fund Investment for at least 10 years don’t have to pay any capital gains produced through their investment.

Of course, paying no capital gains tax is a big incentive for investors. Some research has shown that this has invited bad actors to exploit the benefit for its tax purposes, without caring much about the impact of their investments. Qualified Opportunity Funds that focus too much on cutting costs and maximizing profits run the risk of leading to slumlords doing the legal bare-minimum to stay operational. Alternatively, some well-meaning funds may fail to involve community stakeholders, and inadvertently lead to gentrification or lead to families being priced out of their neighborhoods.

Many argue for a policy update that puts up guardrails, increases transparency and accountability, and shifts the benefits of this policy, so it’s not only the wealthy investors who have something to gain.

Still, there are a few Qualified Opportunity Funds that hold themselves to higher standards of triple bottom line impact. Efforts by Arctaris Impact Investors, Woodforest CEI-Boulos Opportunity Fund, Revitate, Catalyst Opportunity Fund, and JTC Americas show that high-impact OZ strategies are feasible and profitable.

Just like capitalism as a whole, there will always be some groups that look to maximize gain at all cost, while others act sustainably and responsibly — the same goes for Opportunity Funds. But for impact investors who are looking to benefit others, there are opportunities out there to use their wealth as a force for good.

Risk Disclosure:

Investing in Qualified Opportunity Funds involves risks such as market loss, liquidity risk, and business risk, to name a few. Consult with a tax professional and attorney to determine if it aligns with your financial goals and risk tolerance before investing. Read the fund's documentation carefully and remember that tax benefits may not justify the potential risks.

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Intrapreneurs create innovation from within their company.

What does impact investing look like in practice?

Social impact doesn't always happen in a vaccum.

Corporate Social Responsibility is a hot topic nowadays, but how does it actually benefit companies?

Want to invest in bonds while having a positive impact on the world?

Equity crowdfunding allows more people to participate in early stage startup investing.

A growing number of future business leaders are learning about sustainability in their MBA programs.

The 17 SDGs represent aspirational goals that span a range of economic and societal issues, with the intention of providing a better future for all.

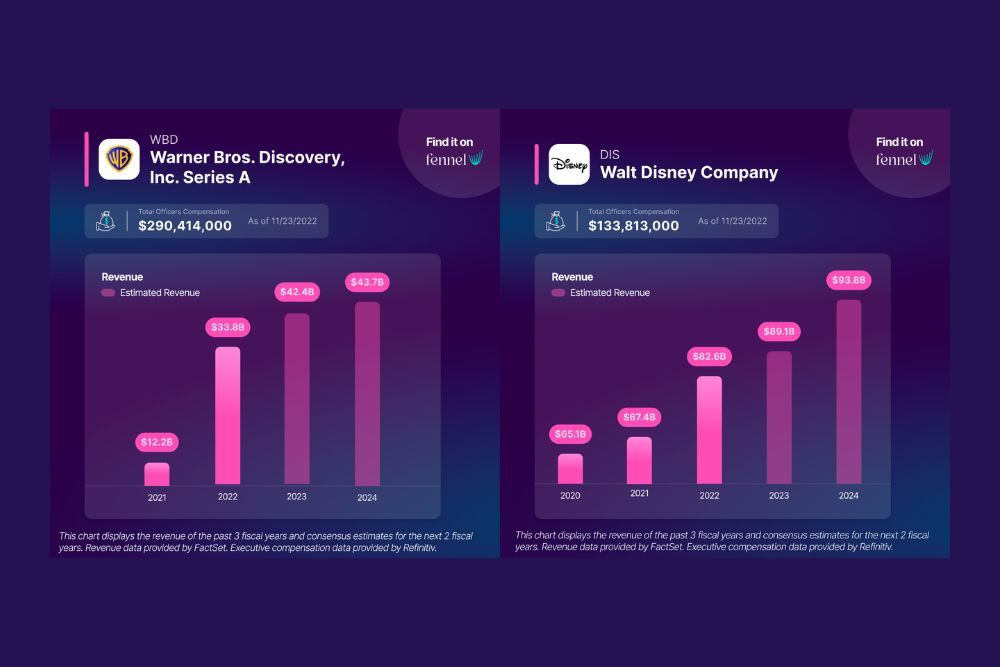

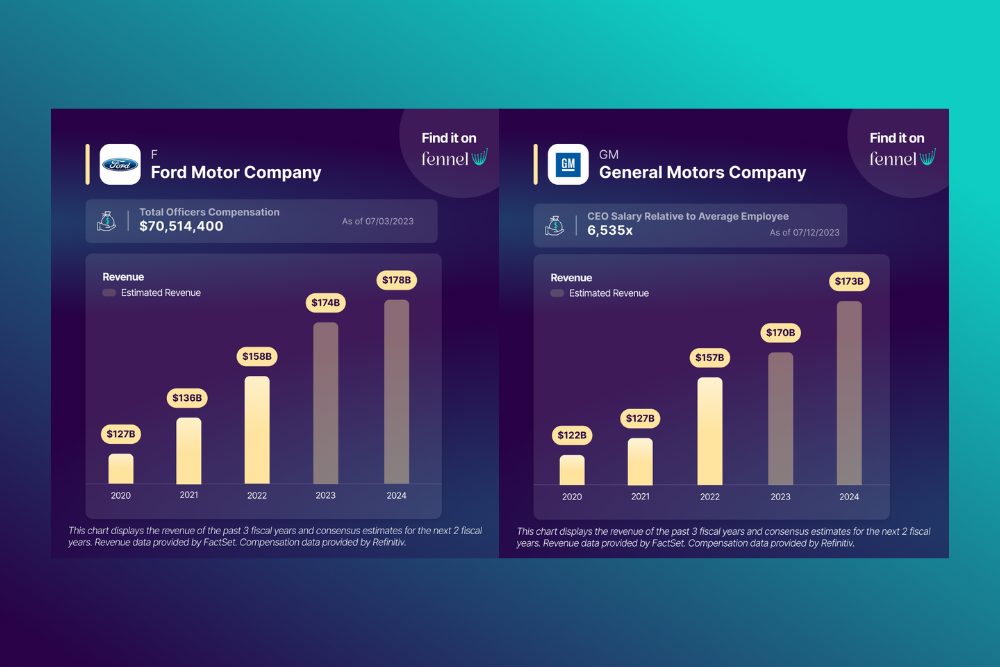

Does it make more financial sense for studios to meet the writers’ and actors’ demands, or not?

Fair pay is one the main issues of the strike, as CEO pay has increased in recent decades while workers’ adjusted wages have decreased.

Take back the power of your investment