Back to Learn page

Back to Learn page

The Financial Stakes of Hollywood's Strikes

Hollywood's facade is decorated by picket lines and placards. The WGA (Writers Guild of America) and SAG-AFTRA (Screen Actors Guild - American Federation of Television and Radio Artists), are currently on strike for their 5th and 3rd respective months, demanding better compensation and working conditions. The implications of this standoff are critical for workers, studios, and shareholders alike.

The Costs of Meeting Demands

The WGA asserts that fulfilling its demands alone would cost the studios a combined $343 million per year, while Moody's estimates that meeting the demands of all three guilds (including the Directors Guild of America) would cost the studios (combined) between $450-600 million annually.

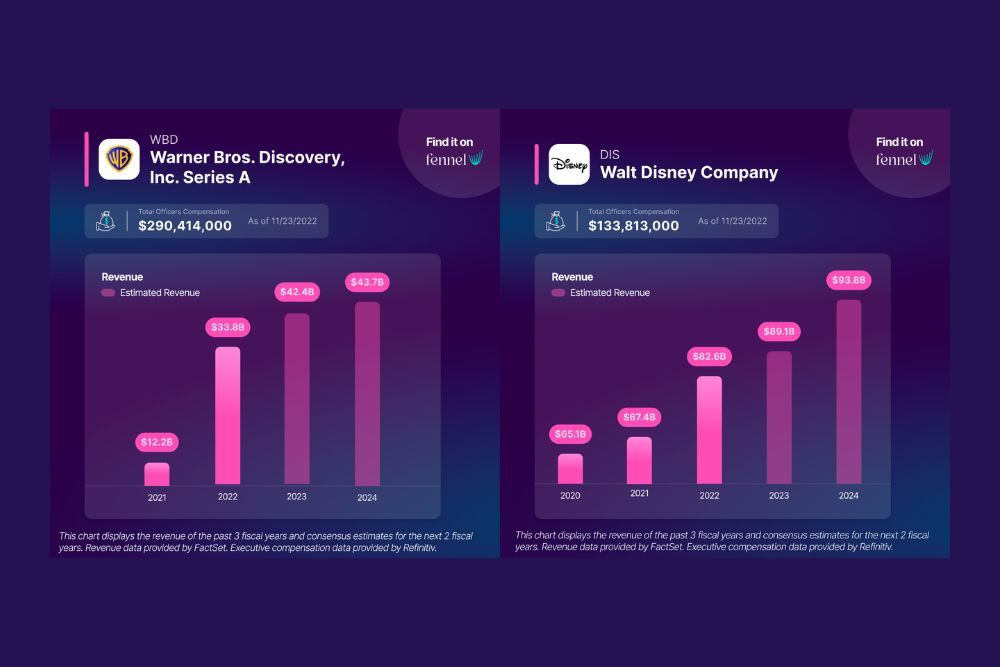

Though these costs might seem hefty, they pale in comparison to the studios' colossal revenues. When digging into the reported numbers, they amount to a fraction of a percent of their annual revenues.

The Costs of Not Meeting Demands

A closer look at the balance sheets reveals that studios could very feasibly meet these demands without torpedoing profitability. Warner Bros. Discovery alone has reported that the ongoing strikes will dent its 2023 earnings by $300-500 million — 6 to 10 times the estimated cost of $47 million to meet the writers’ demands (equivalent to 0.1% of its estimated $42.4 billion in revenue for 2023). If one studio is already facing such losses, the aggregate hit to the industry could be staggering.

Meanwhile, Disney's estimated 2023 revenue is $89.1 billion. It would cost Disney an estimated $75 million to meet WGA’s demands, which accounts for less than 0.1% of that revenue.

Long-term Implications

While the demands may seem burdensome to certain stakeholders, the cost of ongoing strikes may also manifest in the erosion of brand value and investor confidence, along with a blow to future revenues. The effects to content pipelines may cause subscriber numbers to falter, affecting revenue streams and investor returns.

Meanwhile, The SAG-AFTRA and WGA are not just fighting for more money; they're fighting for fair pay, humane treatment, and the survival of their profession amid record inflation and the advent of artificial intelligence in the industry.

Bottom Line

In the end, a fractional increase in operational costs to meet worker demands could very well be a prudent investment to sustain profitability and secure long-term investor returns for film and tv studios.

The financial impacts, however, shouldn’t overshadow that workers are merely protecting their dignity and livelihood. The numbers show that by meeting these demands, studios would be both showing support for their workers and potentially saving money in the short and long term. In this scenario, workers and shareholders may find that their interests are not mutually exclusive, but actually aligned.

Questions for Retail Investors to Ponder

- How might the ongoing strikes impact studios' valuations?

- What is the long-term cost of not addressing worker demands for studios you're invested in?

- Do you consider ethical labor practices as part of your investment criteria?

- If a shareholder vote arises next year on meeting the guilds' demands, how would you vote?

∙ ∙ ∙

The companies shown in inset infographics are included because of their relevance to the Hollywood strikes. The purpose of these infographics is to demonstrate the information provided in the Fennel app for a $4.99/mo. subscription, along with how this information relates to current events.

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

A year ago, we started building an investing app to bring power back to the stakeholders.

20 months ago I had a simple idea: What if capital markets could change?

The name "Fennel" is inspired by the ancient Greek myth of Prometheus.

Fennel is joining forces with We The Investors to provide engaging educational content to help retail investors learn more about capital markets.

Backed by Jeff Cruttenden, founder of Acorns, Capital Factory, Temerity Capital Partners and more, Fennel has raised over $5M in funding to provide transparent financial and ESG-data to investors.

Fennel Financials joins forces with Eventus.

Fennel has been named to Fast Company’s prestigious list of the World’s Most Innovative Companies for 2023, joining a list of businesses paving the way in innovation and highlighting those at the forefront of their respective industries.

The ESG-focused retail investing platform hires Michael Capelli to lead its brokerage operations

Zero commissions doesn't mean zero costs.

ESG & shareholder voting-focused brokerage becomes Certified B Corporation™, highlighting commitment to sustainable and regenerative economy.

Take back the power of your investment