<p><span style="font-weight: 400;">Sometimes, comparing companies is a lot like comparing apples to oranges. Sure they’re both fruit, but they have fundamental differences and you wouldn’t necessarily swap one for the other when following a recipe.</span></p>

<p><span style="font-weight: 400;">Investors have come up with plenty of ways to classify different companies to make comparisons easier, and one of those methods is classifying companies based on their sector.</span></p>

<p><span style="font-weight: 400;">Sectors are broad groups that classify companies based on their industry and what products or services they provide. Although there are a few different frameworks for defining companies by sector, Fennel uses the </span><a href="https://www.msci.com/documents/1296102/11185224/GICS+Methodology+2020.pdf/9caadd09-790d-3d60-455b-2a1ed5d1e48c?t=1578405935658"><span style="font-weight: 400;">Global Industry Classification Standard (GICS)</span></a><span style="font-weight: 400;">. GICS was developed by Morgan Stanley Capital International and Standard & Poor’s in 1999 to provide investors with a way to clearly define different industries, and then classify securities based on those industries.</span></p>

<p><span style="font-weight: 400;">According to GICS, there are currently 11 different sectors. Here’s a list of all of them, as well as some examples of each:</span></p>

<p> </p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Energy </strong><span style="font-weight: 400;">(e.g., oil, gas, and coal companies)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Materials </strong><span style="font-weight: 400;">(e.g., chemical producers, mining companies, and paper product manufacturers)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Industrials </strong><span style="font-weight: 400;">(e.g., transportation companies, capital goods, and commercial & professional services)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Consumer Discretionary </strong><span style="font-weight: 400;">(e.g., apparel companies, luxury goods providers, and restaurants)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Consumer Staples </strong><span style="font-weight: 400;">(e.g., food, beverage, and household product companies)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Health Care </strong><span style="font-weight: 400;">(e.g., pharmaceutical companies, healthcare providers, and biotech companies)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Financials </strong><span style="font-weight: 400;">(e.g., Insurance companies, banks, and mortgage lenders)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Information Technology </strong><span style="font-weight: 400;">(e.g., software companies, tech hardware, and equipment producers)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Communication Services </strong><span style="font-weight: 400;">(e.g., wireless carriers, media companies, and publishers) </span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Utilities </strong><span style="font-weight: 400;">(e.g., water utilities, electric utilities, and renewable energy producers)</span></p>

<p><strong> <strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• </strong>Real Estate </strong><span style="font-weight: 400;">(e.g., property management and development companies, real estate services, and REITs)</span></p>

<p> </p>

<p><span style="font-weight: 400;">Sectors are meant to be broad enough that pretty much every company falls into one of these 11 categories. </span><a href="https://www.msci.com/documents/1296102/11185224/MSCI_GICS_Overview.pdf/cfdc73ec-9704-1685-7742-96bf2c3ec699"><span style="font-weight: 400;">Over 58,000 trading securities</span></a><span style="font-weight: 400;"> have been classified by the GICS framework (representing about 95% of the world’s equity market capitalization), and each one has been assigned to a sector.</span></p>

<p><span style="font-weight: 400;">Sectors are also just the tip of the iceberg within the GICS system. The 11 sectors are then broken into 24 industry groups, 69 industries, and 158 sub-industries. This allows GICS classifications to get more specific when defining exactly what industry a company falls into.</span></p>

<p><span style="font-weight: 400;">For example, the company Harley-Davidson is in the consumer discretionary sector, automobiles & components industry group, automobiles industry, and motorcycle manufacturers sub-industry. You can get down to this level of specificity for any company within the GICS framework, but the sector level is the most broad classification.</span></p>

<p> </p>

<p><strong>Why should investors pay attention to sectors?</strong></p>

<p><span style="font-weight: 400;">One reason investors look at sectors is to diversify their portfolio. As a general rule of thumb, diversification of your portfolio can help you </span><a href="https://www.nerdwallet.com/article/investing/diversification"><span style="font-weight: 400;">avoid risk or market volatility</span></a><span style="font-weight: 400;">. Investing across multiple market sectors may mean you’re less susceptible to this risk.</span></p>

<p><em><span style="font-weight: 400;">(</span></em><em><span style="font-weight: 400;">Important Risk Disclosure</span></em><em><span style="font-weight: 400;">: Diversification does not ensure a profit and may not protect against loss in declining markets.)</span></em></p>

<p><span style="font-weight: 400;">Hypothetically speaking, let’s say a recession means people are more careful with their personal spending habits. This could affect companies in the consumer discretionary sector, like luxury good sellers or automobile manufacturers. Meanwhile, companies in the consumer staples sector, like food and beverage companies, may be less affected. If an investor’s entire portfolio consists of companies in the consumer discretionary sector, their portfolio may take a hit. But if that investor has their portfolio spread out across multiple different sectors, they might be shielded from some of that volatility.</span></p>

<p><span style="font-weight: 400;">However, some investors may choose to look at sectors in order to focus their portfolio on just one industry — essentially doing the opposite of diversification. If they believe that macroeconomic conditions will cause one sector to outperform the others, they may allocate more of their portfolio to that sector.</span></p>

<p><span style="font-weight: 400;">For example, although the S&P 500 is down for the year, </span><a href="https://www.yardeni.com/pub/peacockperf.pdf"><span style="font-weight: 400;">the energy sector has actually grown</span></a><span style="font-weight: 400;"> due to various reasons like the Russia-Ukraine war and demand for fossil fuels. If a savvy investor somehow predicted this trend and invested solely in the energy sector at the start of the year, they would have outperformed someone who spread their portfolio evenly between all sectors. In this scenario, the energy investor opted to take the riskier, less-diversified approach in an attempt to get higher returns.</span></p>

<p><span style="font-weight: 400;">Besides diversification, looking at sectors can help investors make comparisons between different or similar companies. This can be extra useful if the investor considers ESG data when making investments.</span></p>

<p><span style="font-weight: 400;">For example, if an investor is looking at the carbon footprint of oil company X, it might not be fair to compare it to software company Y. That’s because the business operations of these two companies are fundamentally different. Instead, it would be fairer to compare oil company X to other companies within its sector.</span></p>

<p><span style="font-weight: 400;">Sectors can also make ESG screening easier. If an investor is looking to remove companies that do animal testing from their portfolio, it probably makes more sense to look at companies in the consumer staples sector (food companies, agriculture companies, personal product manufacturers, etc.) than it would to screen for animal testing in the financials sector.</span></p>

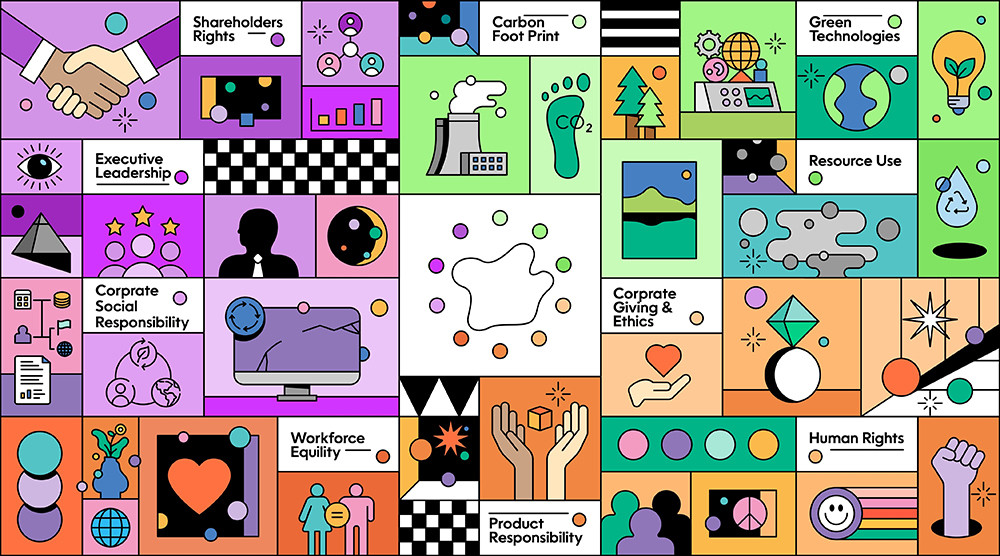

<p><span style="font-weight: 400;">Additionally, companies that provide ESG scores or ratings may take sectors or industry groups into account when calculating those scores. Again, this is because it often makes more sense to compare similar companies when determining ESG performance. If you look at </span><a href="https://fennel.com/fennel101/4"><span style="font-weight: 400;">the Fennel ESG wheel</span></a><span style="font-weight: 400;">, you’ll notice that the ESG scores and data points provided compare the specific company you’re looking at to other companies within the same industry.</span></p>

<p><span style="font-weight: 400;">There are plenty of other reasons to consider sectors when investing, whether that’s analyzing market trends or understanding your portfolio’s sector exposure. But even if you don’t take sectors into account when investing, understanding what they are can give you some more insight into the market at large.</span></p>

<p style="padding-left: 400px;"><br /><br /><strong style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen, Ubuntu, Cantarell, 'Open Sans', 'Helvetica Neue', sans-serif;">• • •</strong></p>

<p><em><span style="font-weight: 400;">The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. </span></em><span style="font-weight: 400;">Employing ESG strategies may not result in favorable investment performance.</span><em><span style="font-weight: 400;"> Securities offered through Fennel Financials, LLC. Member</span></em><a href="http://finra.org/"><em><span style="font-weight: 400;"> FINRA</span></em></a><a href="https://www.sipc.org/"><em><span style="font-weight: 400;"> SIPC</span></em></a><em><span style="font-weight: 400;">.</span></em></p>

What Are Sectors?

Sectors can help you understand the industry of the companies you invest in.

Back to Learn page

Back to Learn page