Back to Learn page

Back to Learn page

Equity Crowdfunding: The Democratization of Startup Investing

On April 5, 2012 President Barack Obama signed the Jumpstart Our Business Startups (JOBS) Act into law. Among loosening oversight and regulations on small businesses, the JOBS Act legalized equity crowdfunding to help drive technological innovation and high-growth enterprises in the United States.

Equity crowdfunding provides both a new method for raising capital for privately-owned businesses, and a new asset class for investors. It involves business owners selling a number of company shares to a pool of investors through regulated online crowdfunding platforms. This type of crowdfunding is different from donation crowdfunding (like GoFundMe) and loan crowdfunding (like Kiva). With equity crowdfunding, startups looking to fundraise have new opportunities to tap into sources of capital, while non-accredited investors can finally break into a small-scale form of angel investing.

Similar to the venture capital field, equity crowdfunding investors buy small shares of early-stage startups to hold for a long time horizon. This is generally due to the fact that crowdfunding investors only see returns in the event of an Initial Public Offering, acquisition by a larger company, reverse buyout, or some other qualifying event. However, this form of investing closely resembles venture capital investing, and chases the same goal of investing in the next high-growth tech company.

Of course, there is always the risk of not seeing returns for many years, or investments losing value. It’s important to keep this in mind.

Equity crowdfunding effectively democratized the venture capital and angel investing spaces, once reserved for high-net worth individuals based primarily in Silicon Valley, New York City, and other select cities. Paired with the widespread use of social media platforms such as Facebook, Instagram, LinkedIn, Reddit, and Twitter, equity crowdfunding has introduced a new generation of digitally-literate Millennials and Zoomers to the world of startup investing. In 2018, equity crowdfunding drove $74M in startup capital to companies, with an additional $100M raised the very next year. Then, while a portion of the financial sector struggled through the pandemic, equity crowdfunding accelerated, channeling a staggering $211M in 2020.

Now more people can participate in this new asset class for relatively small amounts (like $100 investment minimums) depending on the platform used. We have yet to see how much equity crowdfunding will influence inter-generational wealth creation in working and middle class families, nonetheless it is refreshing that access and opportunities in startup investing has increased for a wider array of investors from diverse socioeconomic backgrounds.

If you’re looking to try investing through equity crowdfunding, it’s important to know that each of the platforms have their own rules, investment minimums, and selection of startup companies. If you’re a startup founder looking to raise equity crowdfunding, be sure to review the deal terms. There are several equity crowdfunding platforms out there, including StartEngine, SeedInvest, MicroVentures, Wefunder and Republic.

While the equity crowdfunding space is still in its infancy, its meteoric rise indicates that it’s worth keeping an eye on. On top of this, there are many startups that have benefited from the new model. For example, startup company NowRx used an equity crowdfunding strategy to raise capital for both its official launch and an aggressive scale-up during the height of the COVID-19 pandemic. It raised a $750K seed round in 2017, then a $7M series A, and then an impressive $20M series B — primarily on the StartEngine platform.

Equity crowdfunding is expected to grow, with experts predicting almost $200B growth in market share from 2021 to 2025. Whether you’re a CEO looking to raise money or an investor trying to break into the private market, equity crowdfunding has proven itself as a viable alternative to traditional channels, some of which have been marred by gatekeeping and institutionalized bias.

Similarly, equity crowdfunding may serve as a boon for diverse founders. Despite the rhetoric from the VC industry claiming to support minority groups, a measly 2.6% of VC funding went to Black and latinx founders from 2015 to 2020. Meanwhile, only 2% of VC money in 2021 went to female founders. And on the investor side, white men represent 53% of all VC investors and control a whopping 93% of all VC dollars. In comparison, 33% of startups on StartEngine have a BIPOC founder and 44% of all funds raised on Republic went to female founders.

The “old boys club” may have historically controlled access to VC money but along came equity crowdfunding — both a technological and legislative innovation that has started to disrupt the system. Equity crowdfunding has the potential to knock down barriers, and provide both access to capital and investment opportunities to a wider variety of people, connecting diverse founders with diverse investors.

Crowdfunding also has significant risks to consider such as liquidity risk, risk of loss, fees and expenses, limited information and more. Crowdfunding offers are speculative and investors should be able to afford and be prepared to lose their entire investment. For more information, view Investor Bulletin: Regulation Crowdfunding for Investors.

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. This is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Employing ESG strategies may not result in favorable investment performance. Securities offered through Fennel Financials, LLC. Member FINRA, SIPC.

Expand your knowledge further

Intrapreneurs create innovation from within their company.

What does impact investing look like in practice?

Social impact doesn't always happen in a vaccum.

Corporate Social Responsibility is a hot topic nowadays, but how does it actually benefit companies?

Want to invest in bonds while having a positive impact on the world?

The Tax Cuts and Jobs Act of 2017 helped create a new type of impact investing.

A growing number of future business leaders are learning about sustainability in their MBA programs.

The 17 SDGs represent aspirational goals that span a range of economic and societal issues, with the intention of providing a better future for all.

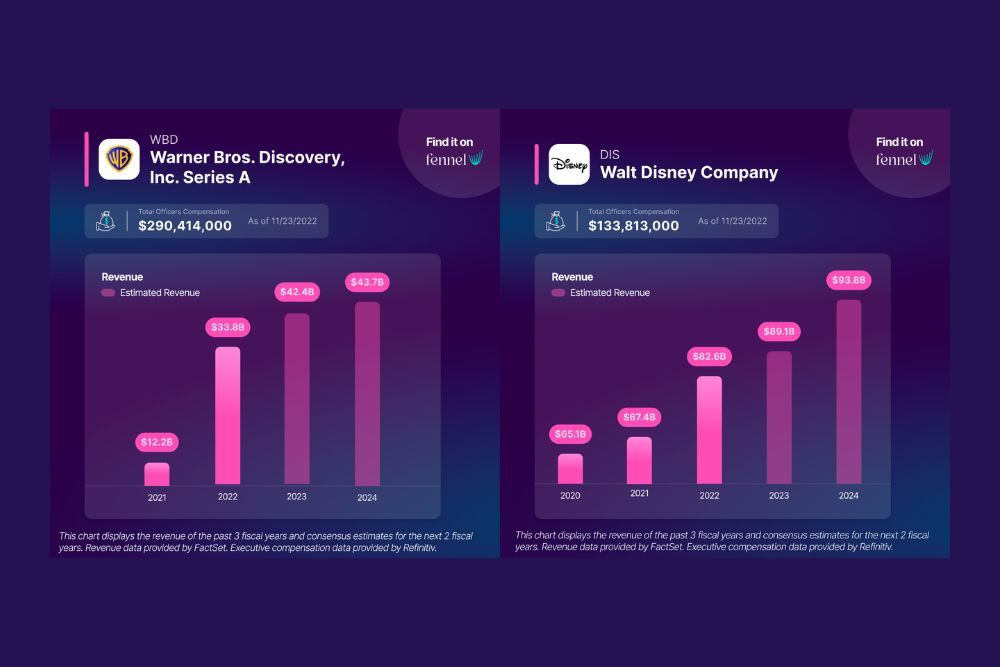

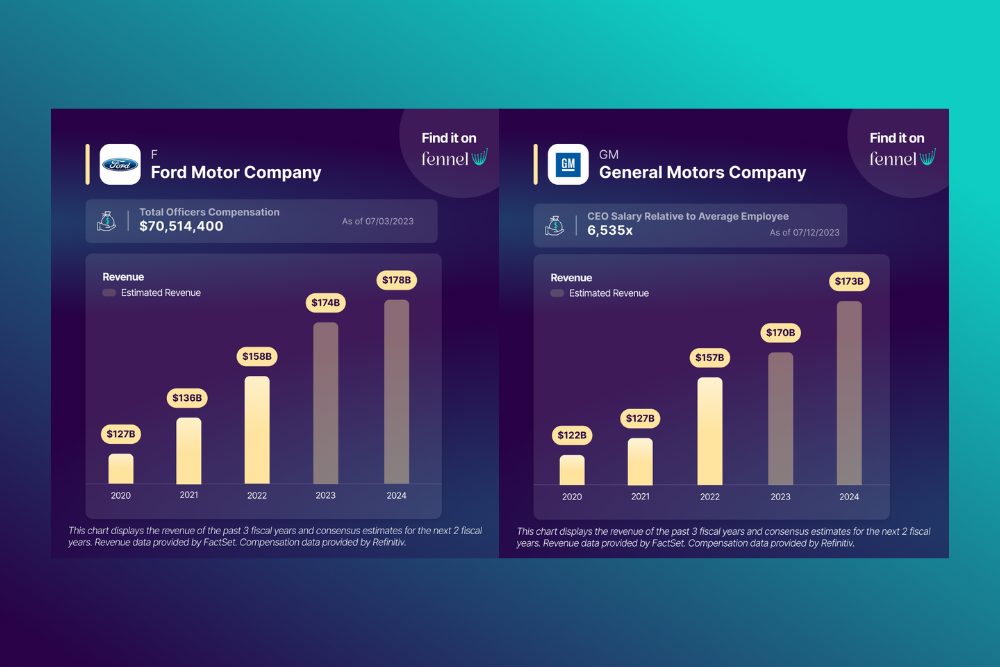

Does it make more financial sense for studios to meet the writers’ and actors’ demands, or not?

Fair pay is one the main issues of the strike, as CEO pay has increased in recent decades while workers’ adjusted wages have decreased.

Take back the power of your investment