Back to Learn page

Back to Learn page

Sustainable Companies and Funds Outperforming in the Short- and Long-Term, Studies Find

What does sustainability have to do with financial performance? A 9-year analysis from Kroll and Morgan Stanley's mid-year 2023 report both indicate that sustainable investments aren’t just holding their own—they're outperforming other options.

Short-Term Returns

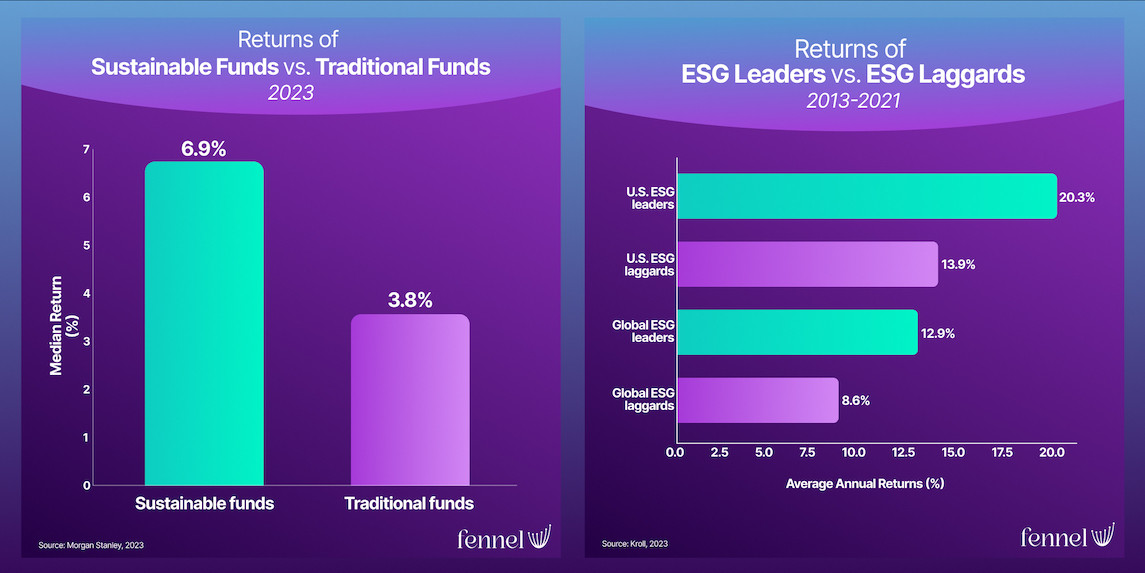

"In the first half of 2023, sustainable funds saw a median return of 6.9%, beating traditional funds’ 3.8%," says Morgan Stanley's Jessica Alsford. This data, highlighted in their Sustainable Reality report, showcases the resilience of ESG-focused investments in recent market conditions. Not only did these funds reverse their underperformance from the previous year, but they also attracted a staggering $57 billion in new inflows.

In terms of different asset classes, sustainable equity funds showed a greater difference, with a 10.9% median return vs. traditional equity funds’ 8%. Meanwhile, sustainable fixed income funds (i.e. bonds) saw median returns of 3.8%, which was nearly double the return of their traditional counterparts (at 2.2%). The report also highlights that assets under management (AUM) in sustainable funds have continued to grow in proportion to alternatives, now comprising close to 8% of the total global AUM in funds.

Long-Term Gains

For those looking at longer time horizons, the value proposition for ESG integration is even stronger. Kroll's study, which spanned nine years and examined more than 13,000 companies globally, revealed that companies with higher ESG ratings "generally outperformed" those with lower ratings. Specifically, companies categorized as ESG “leaders” had an average annual return of 12.9% over the nine-year period, compared to 8.6% for “laggard” companies.

In the U.S. alone, ESG leaders earned an annual compound return of 20.3%, compared to 13.9% for laggard companies. This represents an almost 50% premium in terms of relative performance by leading ESG companies, according to the study.

Where do sustainability & “ESG” belong?

Integrating ESG isn’t just about saving face; it's about balancing an investment approach to consider both short-term market dynamics and long-term value creation. "Despite short-term fluctuations in performance, sustainable funds appear to be holding steady [especially] for investors targeting longer-term horizons," notes the Sustainable Reality report.

While sustainability and corporate responsibility may be framed by some as mere talking points, the numbers reveal these factors may be essential to a well-rounded investment strategy. As Carla Nunes at Kroll puts it: "While time will tell whether the ESG label ultimately prevails, it doesn’t really matter because the premise behind the strategy isn’t going away."

Read more: 20 ESG ETFs Available On Fennel Right Now

Questions for Retail Investors to Consider:

∙ Do you think there is extra financial risk when investing in companies with unsustainable practices?

∙ How do you identify ESG-related risks?

∙ Do you look for opportunities associated with companies that innovate in their sustainability?

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Greenwashing is a superficial and sometimes misleading way companies claim sustainability.

Some investors have a hypothesis that ESG investments generate stronger, more sustainable returns over the long term.

There are a lot of terms used in the world of impact investing, what do they all mean?

Active ownership could help ESG investors push for more impactful change.

What does impact investing look like in practice?

Proactive companies prioritize ESG in their business practices.

Social impact doesn't always happen in a vaccum.

An ESG index can help you track the performance of certain ESG-vetted companies over time.

Let's take a look back at some of the things that happened during last year's AGM season.

Want to invest in bonds while having a positive impact on the world?

Take back the power of your investment