Back to Learn page

Back to Learn page

Fennel’s Glossary of Financial Terms

Beta, enterprise value, expense ratio ... what does it all mean? Here are definitions for the terms you'll see in the Fennel app.

At Fennel, we believe that individual investors should have access to as much data as the traders on Wall Street do. That’s why we’ve packed all that ESG, financial, and shareholder voting information into our app.

But, we also acknowledge that a lot of data can be overwhelming at times, especially when it comes to financial data. This data can tell you about the health of a company’s business or the performance of its stock, but it also involves understanding a fair amount of terms and numbers.

That’s why we’ve put together this glossary as a cheat sheet to help you remember what all the financial terms measure and mean. With this glossary, we hope you feel well-equipped to invest based on the metrics that matter to you.

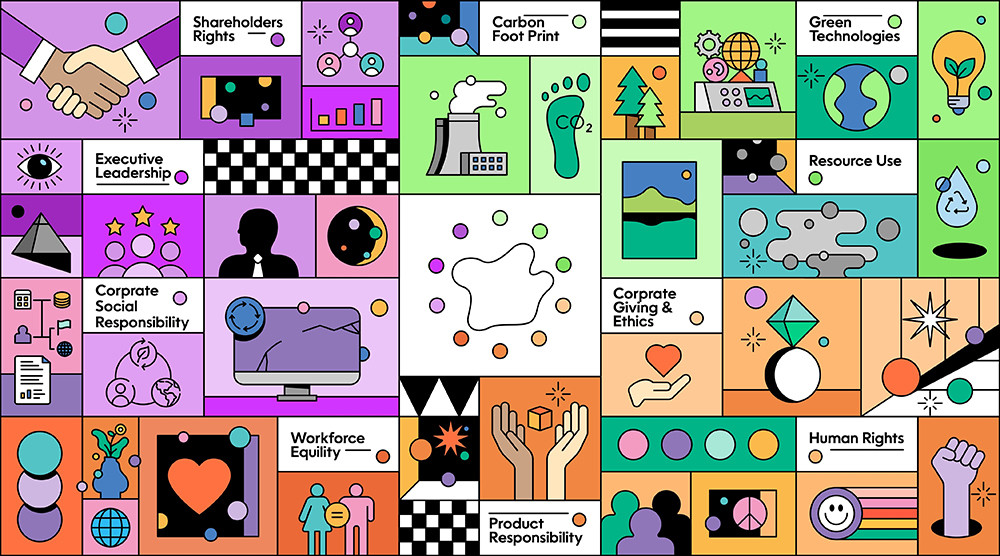

(For a rundown on Fennel’s ESG data, you can read our explainer here.)

Annual Revenue

Annual revenue tells you how much money a company generates by selling its products or services over the course of a year. Fennel gets this information by looking at the net revenue or net sales that a company generated in its most recent fiscal year.

Revenue differs from profit because it doesn’t include the expenses that a company had to pay in order to generate that revenue. If you subtract a company’s expenses from its revenue you’ll get its net income or net profit.

Beta

Beta is a measurement that represents a stock or ETF’s volatility.

To measure this, beta compares how much the price of that security changes relative to the broader market on average. The market, which is usually represented by a benchmark like the S&P 500 or Russell 1000, is given a beta value of 1.0.

For example, if the security’s price tends to experience similar percentage changes as the broader market (on both up and down days), it’ll have a beta value close to 1.0. If the security’s price swings more wildly than the broader market, it’ll have a beta value greater than 1.0 — the higher the value, the greater the variance. But if the security moves less than the broader market on average, its beta value will be less than 1.0.

Change on Day

This measures how much the price of a stock or ETF has changed between the close of the prior trading day and where the price is currently. This change can be represented by either a dollar amount ($) or by a percentage (%).

Dividend

A dividend is a sum of money that a company pays out to its shareholders in regular intervals (often quarterly) as a way to share its profits.

If an investor is interested in collecting dividends, they may also want to know about a company’s dividend rate and dividend yield.

The dividend rate is the company’s annual dividend payment per share (as determined by the company). Sometimes, if you hear an investor talk about a company’s “dividend” in terms of dollars per share — as in, “this company pays a dividend of $1.22 per share” — they are actually talking about its dividend rate.

The dividend yield, on the other hand, is a ratio that describes how much the dividend pays out relative to that company’s share price (as a percentage). So, if a company’s share price is $10, and its dividend rate is $1.22 per share per year, the dividend yield is 12.2%.

Some ETFs pay out dividends too if the underlying assets in that ETF pay dividends.

Earnings Per Share (EPS)

Earnings per share is a calculation used to help estimate a company’s value. EPS takes a company’s net profits (which, as mentioned above, is annual revenue minus expenses), then subtracts the company’s dividends (also mentioned above), and then divides that total by the number of outstanding shares. Thus, this calculation gives investors an estimate of how much the company is earning per share.

The Fennel app includes both actual earnings per share, which uses company reported earnings from previous fiscal years to calculate EPS, as well as estimated earnings per share, which calculates EPS for the current and next fiscal year based on what analysts estimate earnings will be. (These analyst estimates are provided by FactSheet).

Enterprise Value

Enterprise value is another calculation that can help investors figure out how much a company is worth. A company’s enterprise value is equal to its market capitalization (the number of shares times the share price), plus the company’s debt and minority interest, then minus the company’s cash. It can be seen as slightly more comprehensive than market cap because it takes a company’s debt and in hand cash into account.

Last Price

This is a stock’s or ETF’s most recent share price, either from the current or most recent trading session at close.

Market Capitalization

Market Capitalization (often shortened to “market cap”) aims to calculate a company’s total equity value. It does this by multiplying the company’s share price by the number of outstanding shares.

Sometimes, investors classify companies by size using market cap. Companies are split into small cap (when market cap is less than $2 billion), mid cap (when market cap is between $2 billion and $10 billion), and large cap (when market cap is greater than $10 billion).

Open / High / Low

These are three different price measurements for the current, or most recent trading session. Open refers to the share price at market open. High refers to the highest value that the share price reached during the trading session. And low refers to the lowest value that the share price reached.

Price

This one may seem self-explanatory, but price refers to the current or most recent share price in US dollars. It’s often used to calculate other financial metrics, such as market capitalization or price-to-book.

Price-to-Book (P/B)

A ratio that is used to compare a company’s market value (the price that its shares are trading at) to its book value (the value of the assets on its balance sheet minus liabilities). P/B is calculated by dividing the company’s current share price by the most recently reported book-value-per-share.

P/B can also be calculated for ETFs by taking the weighted average of the P/B values for that ETF’s underlying holdings (i.e, stocks).

Price-to-Earnings (P/E)

Another ratio, price-to-earning compares the company’s share price to its annual earnings per share (EPS). Another way to think about P/E is to view it as how much an investor pays to get a dollar’s worth of company earnings. It’s also sometimes referred to as the “earnings multiple.”

P/E can be calculated as trailing P/E (which uses a company’s reported EPS from its most recent fiscal year), or as forward P/E (which uses EPS estimates calculated by analysts for the current fiscal year).

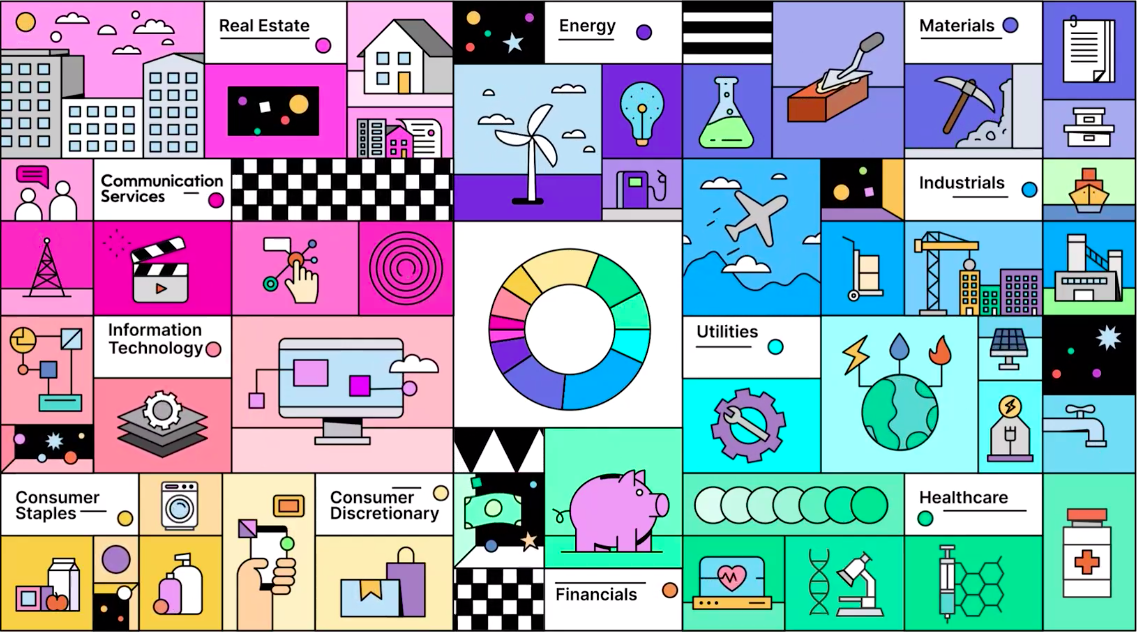

Sector

A way of classifying companies by the industry they operate in (or where their revenue comes from). The Global Industry Classification Standard (GICS) is responsible for classifying companies by their sector.

To learn more about the 11 different sectors, you can read our blog post here.

Theme

Another way of classifying companies based on the area they operate in. While sector can be seen as the type of business a company is, the theme has more to do with industry trends and the company’s area of focus. Themes may be more specific than sectors.

For example, Information Technology is one of the 11 sectors, but Cybersecurity is one of the themes listed in the Fennel app.

Total Debt to Equity Ratio

As hinted in the name, this ratio is calculated by dividing the total debt a company has by the most recent value of the shareholders’ total equity, and then multiplying by 100. This measurement can also be used to tell investors more about how leveraged a company is (since it compares how much the company owes in relation to its equity value).

Volume

Volume refers to the total number of shares that are being traded. Volume can be calculated for the current trading period (referred to as today’s volume), the most recent trading period, or can be averaged out over time. For example, Fennel calculates a security’s average daily volume by taking the mean of a security’s volume over the most recent 30 days.

Some investors look at a security’s volume as an indicator of its activity or momentum. It stocks are being trading more frequently, that may tell you more about the popularity of that stock, or if large transactions are being placed.

52-Week Range

The 52-week range tells you how much a security’s price has moved (roughly) over the past year. It’s calculated by comparing the highest price that security reached over the past 52 weeks (the 52-week high) to the lowest price (the 52-week low).

*ETF Terms*

Fennel allows investors to buy and sell both stocks and ETFs. While stocks represent shares of a single publicly traded company, exchange-traded funds (ETFs) act as a pooled investment, which can represent several different underlying stocks or assets.

Since ETFs differ from stocks, we’ve included a few terms that are used in the Fennel app to provide data about ETFs. Investors should consider carefully information contained in an ETF’s prospectus or, if available, the summary prospectus, including information about investment objectives, risks, charges, and expenses. You can request a prospectus by contacting customer support. Please read the prospectus carefully before investing.

Assets Under Management

Sometimes abbreviated as AUM, this refers to the total market value of all an ETF’s holdings.

Expense Ratio

ETFs don’t just appear out of thin air, they are usually created and managed by some organization. The expense ratio refers to the operating costs that it takes to manage an ETF’s portfolio (for things like management fees, marketing, distribution, administration, distribution, and other expenses). These expenses are then expressed as a percentage of the fund’s average net assets.

Number of Holdings

This refers to the number of underlying securities held in an ETF. Some ETFs consist of many different underlying stocks, others may have less, while some ETFs only have one (known as single-stock ETFs).

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Employing ESG strategies may not result in favorable investment performance. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

You may already know that owning stock means owning a portion of a specific company

Fennel is giving you even more control over your portfolio by letting you decide how your orders get routed.

Sectors can help you understand the industry of the companies you invest in.

Here's what you should know about Fennel's real-time news feature.

Screening is one way to incorporate ESG into your portfolio.

If you've ever found yourself nodding along to conversations about investing while secretly wondering if everyone else in the room is speaking a different language, you're not alone.

Some brokerages use payment for order flow to generate extra revenue, but at what cost?

How a company acts affects more than just its product or its bottom line, it affects the world around it — for better or for worse

Think of the Fennel ESG wheel as an ESG report card.

In any market, investors are always looking for the next edge

Take back the power of your investment