Back to Learn page

Back to Learn page

What Are Sectors?

Sectors can help you understand the industry of the companies you invest in.

Sometimes, comparing companies is a lot like comparing apples to oranges. Sure they’re both fruit, but they have fundamental differences and you wouldn’t necessarily swap one for the other when following a recipe.

Investors have come up with plenty of ways to classify different companies to make comparisons easier, and one of those methods is classifying companies based on their sector.

Sectors are broad groups that classify companies based on their industry and what products or services they provide. Although there are a few different frameworks for defining companies by sector, Fennel uses the Global Industry Classification Standard (GICS). GICS was developed by Morgan Stanley Capital International and Standard & Poor’s in 1999 to provide investors with a way to clearly define different industries, and then classify securities based on those industries.

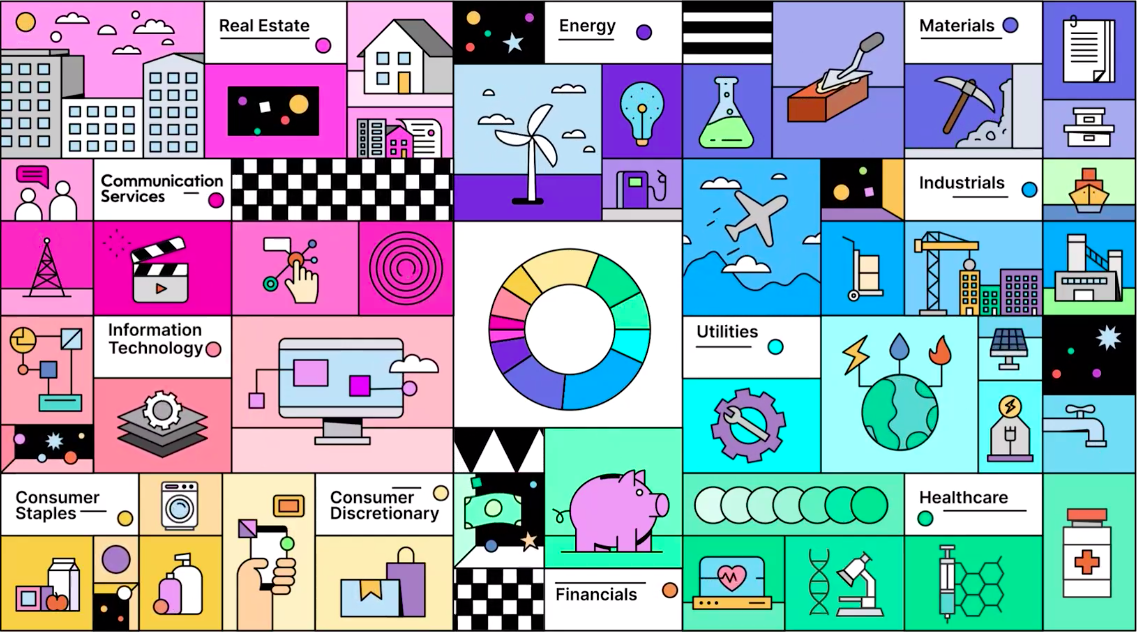

According to GICS, there are currently 11 different sectors. Here’s a list of all of them, as well as some examples of each:

• Energy (e.g., oil, gas, and coal companies)

• Materials (e.g., chemical producers, mining companies, and paper product manufacturers)

• Industrials (e.g., transportation companies, capital goods, and commercial & professional services)

• Consumer Discretionary (e.g., apparel companies, luxury goods providers, and restaurants)

• Consumer Staples (e.g., food, beverage, and household product companies)

• Health Care (e.g., pharmaceutical companies, healthcare providers, and biotech companies)

• Financials (e.g., Insurance companies, banks, and mortgage lenders)

• Information Technology (e.g., software companies, tech hardware, and equipment producers)

• Communication Services (e.g., wireless carriers, media companies, and publishers)

• Utilities (e.g., water utilities, electric utilities, and renewable energy producers)

• Real Estate (e.g., property management and development companies, real estate services, and REITs)

Sectors are meant to be broad enough that pretty much every company falls into one of these 11 categories. Over 58,000 trading securities have been classified by the GICS framework (representing about 95% of the world’s equity market capitalization), and each one has been assigned to a sector.

Sectors are also just the tip of the iceberg within the GICS system. The 11 sectors are then broken into 24 industry groups, 69 industries, and 158 sub-industries. This allows GICS classifications to get more specific when defining exactly what industry a company falls into.

For example, the company Harley-Davidson is in the consumer discretionary sector, automobiles & components industry group, automobiles industry, and motorcycle manufacturers sub-industry. You can get down to this level of specificity for any company within the GICS framework, but the sector level is the most broad classification.

Why should investors pay attention to sectors?

One reason investors look at sectors is to diversify their portfolio. As a general rule of thumb, diversification of your portfolio can help you avoid risk or market volatility. Investing across multiple market sectors may mean you’re less susceptible to this risk.

(Important Risk Disclosure: Diversification does not ensure a profit and may not protect against loss in declining markets.)

Hypothetically speaking, let’s say a recession means people are more careful with their personal spending habits. This could affect companies in the consumer discretionary sector, like luxury good sellers or automobile manufacturers. Meanwhile, companies in the consumer staples sector, like food and beverage companies, may be less affected. If an investor’s entire portfolio consists of companies in the consumer discretionary sector, their portfolio may take a hit. But if that investor has their portfolio spread out across multiple different sectors, they might be shielded from some of that volatility.

However, some investors may choose to look at sectors in order to focus their portfolio on just one industry — essentially doing the opposite of diversification. If they believe that macroeconomic conditions will cause one sector to outperform the others, they may allocate more of their portfolio to that sector.

For example, although the S&P 500 is down for the year, the energy sector has actually grown due to various reasons like the Russia-Ukraine war and demand for fossil fuels. If a savvy investor somehow predicted this trend and invested solely in the energy sector at the start of the year, they would have outperformed someone who spread their portfolio evenly between all sectors. In this scenario, the energy investor opted to take the riskier, less-diversified approach in an attempt to get higher returns.

Besides diversification, looking at sectors can help investors make comparisons between different or similar companies. This can be extra useful if the investor considers ESG data when making investments.

For example, if an investor is looking at the carbon footprint of oil company X, it might not be fair to compare it to software company Y. That’s because the business operations of these two companies are fundamentally different. Instead, it would be fairer to compare oil company X to other companies within its sector.

Sectors can also make ESG screening easier. If an investor is looking to remove companies that do animal testing from their portfolio, it probably makes more sense to look at companies in the consumer staples sector (food companies, agriculture companies, personal product manufacturers, etc.) than it would to screen for animal testing in the financials sector.

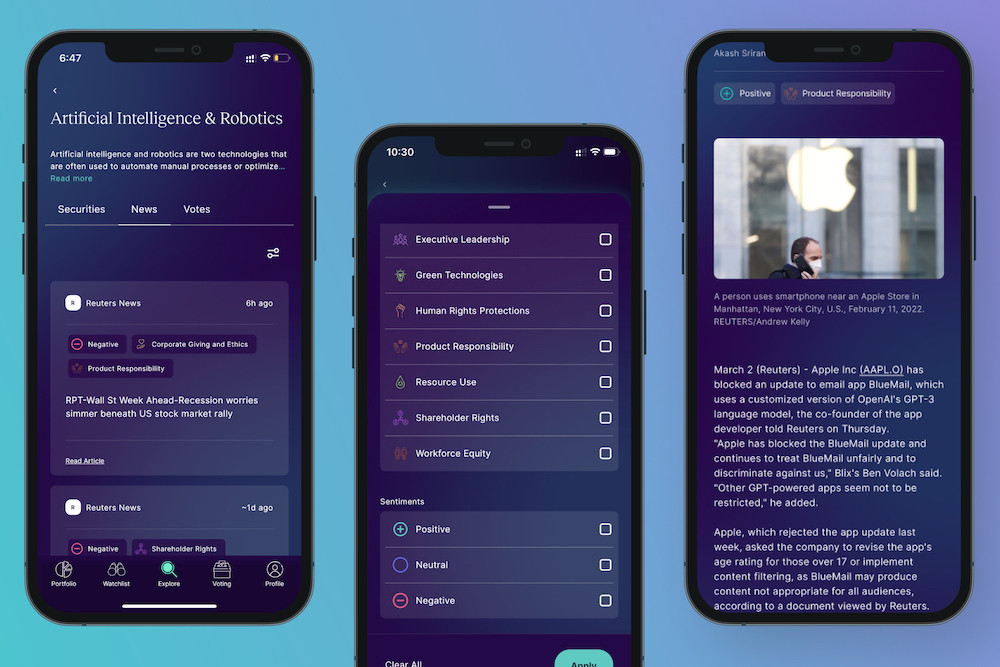

Additionally, companies that provide ESG scores or ratings may take sectors or industry groups into account when calculating those scores. Again, this is because it often makes more sense to compare similar companies when determining ESG performance. If you look at the Fennel ESG wheel, you’ll notice that the ESG scores and data points provided compare the specific company you’re looking at to other companies within the same industry.

There are plenty of other reasons to consider sectors when investing, whether that’s analyzing market trends or understanding your portfolio’s sector exposure. But even if you don’t take sectors into account when investing, understanding what they are can give you some more insight into the market at large.

• • •

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Employing ESG strategies may not result in favorable investment performance. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Think of the Fennel ESG wheel as an ESG report card.

Screening is one way to incorporate ESG into your portfolio.

How a company acts affects more than just its product or its bottom line, it affects the world around it — for better or for worse

You may already know that owning stock means owning a portion of a specific company

Here's what you should know about Fennel's real-time news feature.

In any market, investors are always looking for the next edge

Fennel is giving you even more control over your portfolio by letting you decide how your orders get routed.

If you've ever found yourself nodding along to conversations about investing while secretly wondering if everyone else in the room is speaking a different language, you're not alone.

Sectors can help you understand the industry of the companies you invest in.

Beta, enterprise value, expense ratio ... what does it all mean? Here are definitions for the terms you'll see in the Fennel app.

Take back the power of your investment