Back to Learn page

Back to Learn page

What Is ESG Screening?

Screening is one way to incorporate ESG into your portfolio.

Impact investing grew exponentially in 2021, as more people took into account how companies impact the world when deciding whether or not to invest in them. A 2020 IFC report, estimated the size of impact investing at $2.1 trillion AUM, but it projected that the market could grow to $26 trillion under the right conditions. This growth could cause a huge industry shakeup with investors prioritizing conscientious companies, while pushing established businesses to shift their practices to meet the moment.

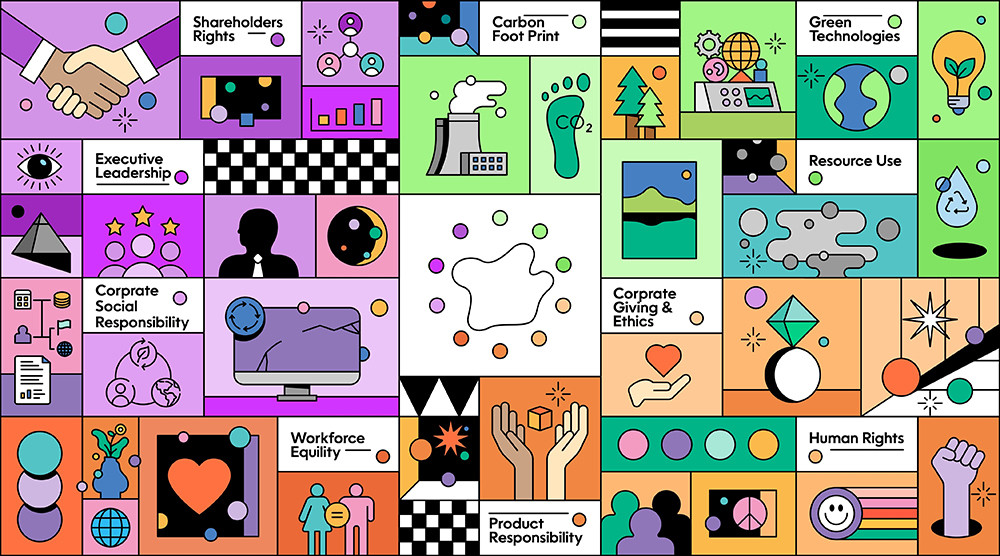

This increase in impact investing means that a growing number of investors are interested in seeing information about companies that goes beyond just the balance sheets. They want to see ESG (Environmental, Social, and Governance) data. By reviewing data like a company’s carbon footprint, commitment to diversity in the workplace, or political donations, investors can learn about how that company affects the world at large.

Finding The Data

But sometimes this is easier said than done. One challenge in impact investing is knowing what to do with all the ESG data. Traditional investors can simply look at a rising stock price, but if you want to evaluate a company based on its effect on society, you need ESG screening.

The perfect company doesn't exist, but ESG screening helps you invest in the companies that are closest to your ideals. It’s essential to think about what issues are most important to you, so you know what to look for in a company and what to avoid.

Accentuate the positive, eliminate the negative

Once an investor figures out the issues important to them, it becomes easier to look for companies that match those ethics. This could be a company with female leadership, a company drastically reducing its carbon footprint, or a company that speaks out against laws that limit equality. Actively choosing companies to invest in based on their beneficial ESG impacts is called positive screening.

On the opposite side, there may be certain practices that make you want to avoid or divest from a company. For example, a company could be a significant contributor to climate change, or could be known for unethical business practices like using child labor. Actively avoiding companies that have a harmful ESG impact is called negative screening. Define what’s unacceptable for you and invest accordingly.

ESG investing involves a combination of positive and negative screening, but some companies and industries are in transition, which makes it harder to put them in the positive or negative column. For instance, a large automobile manufacturer might be in the process of transitioning towards renewable energy usage, but they might still have a large carbon footprint, and thus are unlikely to be ESG leaders.

Because outcomes vary across industries, investors might use a best-in-class philosophy and make investments that encourage companies transitioning towards more sustainable practices but aren’t there yet. That’s why data provider MCSI rates companies as Leaders, Average, or Laggards. When impact investing, you may want to avoid a laggard, but some upper-end “average” companies could show potential, especially with more conscientious investors taking part in shareholder votes.

Decoding The Data

Finding and understanding ESG data on your own can be complicated. Without third-party verification, it’s difficult to know whether a company’s sustainability efforts are misrepresented, or whether a company is making unsubstantiated claims. The European Commission surveyed numerous company websites for businesses in the consumer goods space. The commission found that of the 344 “green” or “eco-friendly” claims made by those companies, 42% of those claims could be labeled as exaggerated, false, or deceptive — and thus “could potentially qualify as unfair commercial practices under EU rules.”

That’s why there are a handful of analytics companies that dig through self-reported and public regulatory data in order to compile a company’s ESG information. The analytics companies will then take this data and create a company rating or ESG score. While there is no standardized rating system, at Fennel we use data collected by Refintiv, as well as its ESG scoring system.

ESG ratings make this data more accessible for everyday investors, making it easier for them to align their personal ethics with the companies they invest in. Through impact investing and ESG screening, investors are showing companies what they prioritize and how they want to shape the world.

∙ ∙ ∙

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Think of the Fennel ESG wheel as an ESG report card.

If you've ever found yourself nodding along to conversations about investing while secretly wondering if everyone else in the room is speaking a different language, you're not alone.

Some brokerages use payment for order flow to generate extra revenue, but at what cost?

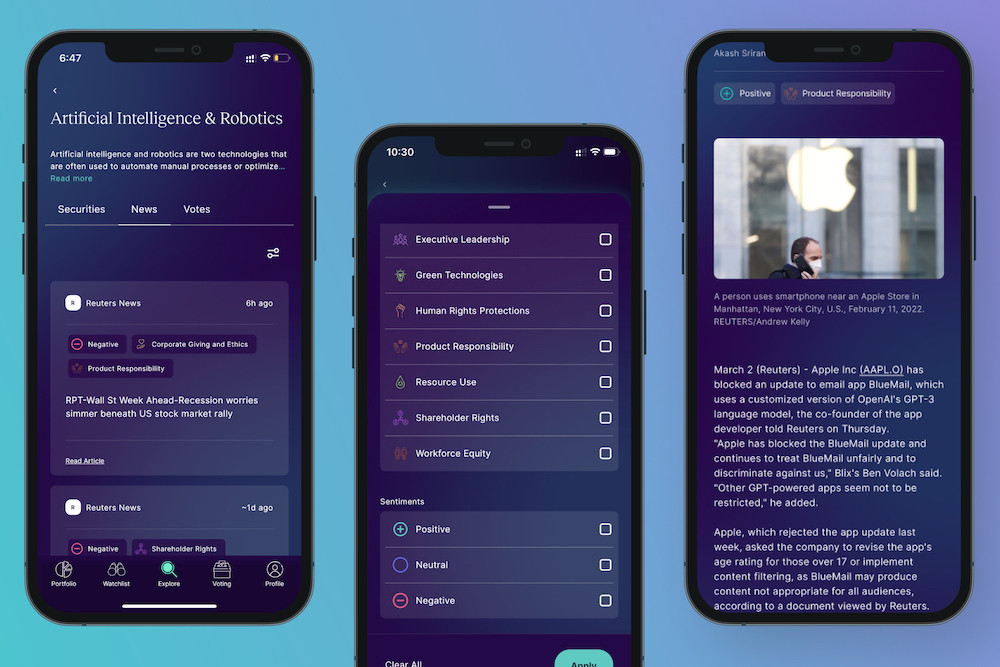

Here's what you should know about Fennel's real-time news feature.

Beta, enterprise value, expense ratio ... what does it all mean? Here are definitions for the terms you'll see in the Fennel app.

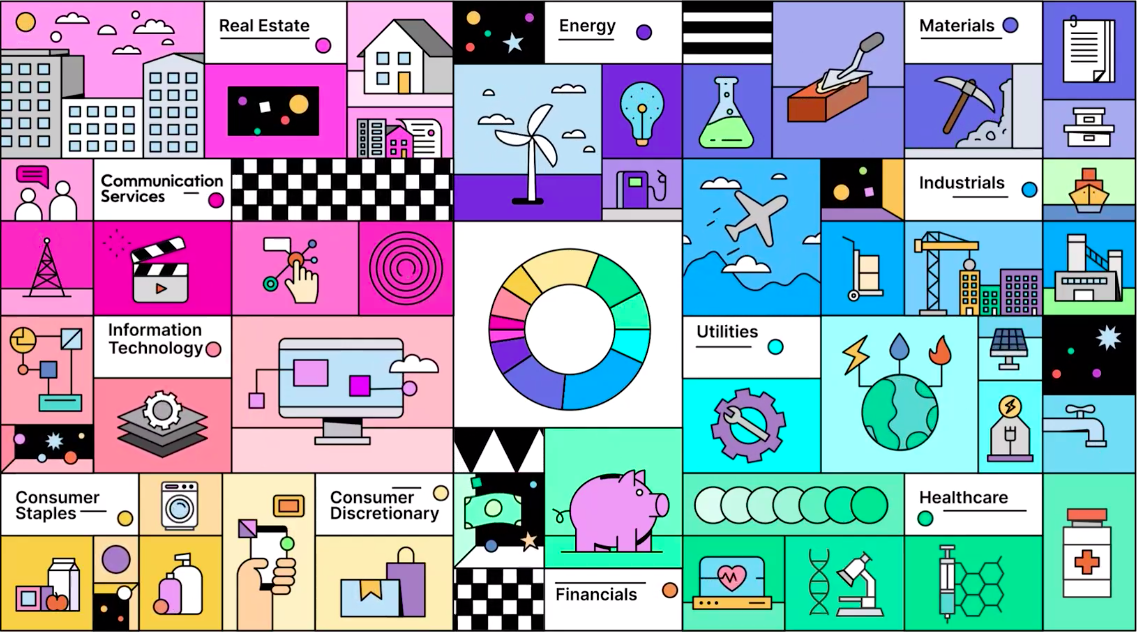

Sectors can help you understand the industry of the companies you invest in.

In any market, investors are always looking for the next edge

How a company acts affects more than just its product or its bottom line, it affects the world around it — for better or for worse

You may already know that owning stock means owning a portion of a specific company

Screening is one way to incorporate ESG into your portfolio.

Take back the power of your investment