Back to Learn page

Back to Learn page

This Just In... Fennel's In-App News

Here's what you should know about Fennel's real-time news feature.

You’ve done your research. You’ve analyzed a company’s finances — its price-to-book, earnings per share, forecasted revenue, etc. You’ve even checked out several of its ESG data points to see if there were any glaring risks. You’re ready to invest.

But when you find the company on the Fennel app, you notice that it’s down 4% that day. Your research showed you that this was a good investment. Is this 4% decline a bad sign? Or is it a buying opportunity? What’s going on?

That’s where news comes in. The price of stocks and ETFs fluctuate every day. Sometimes this is due to market swings or macroeconomic conditions, but other times these swings are related to something specific that’s happening right now.

Staying up-to-date on the news can help you learn more about what the market or an underlying company is going through, which may help inform your buying or selling decisions. That’s why Fennel has integrated a news feature directly into the app.

We’re excited about providing in-app news to our users, especially because it was one of the most asked for features by our beta testers.

First, here are some details you should know about the Fennel news feature:

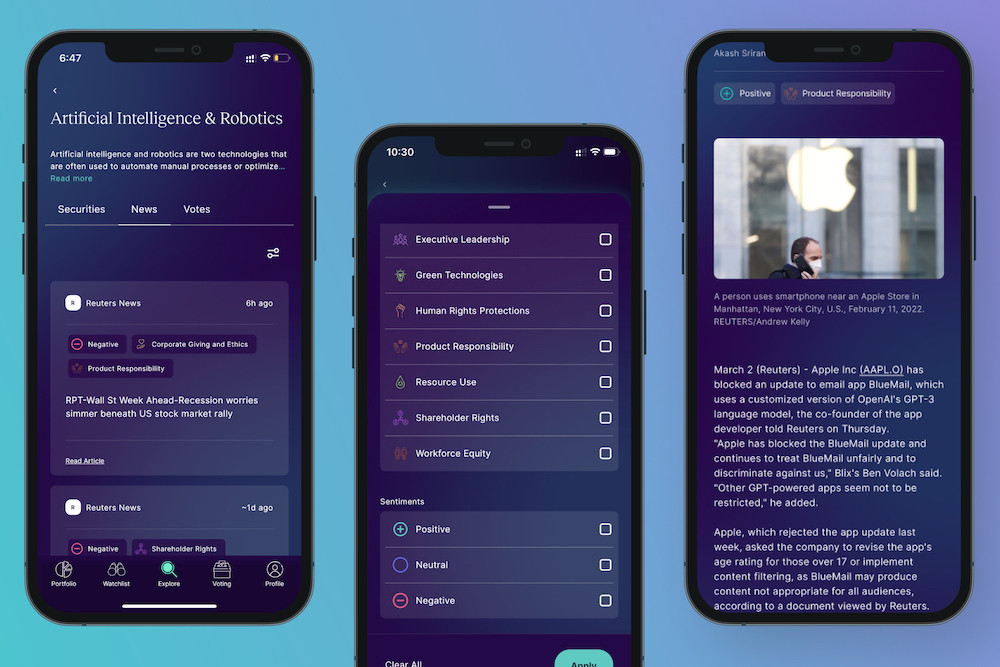

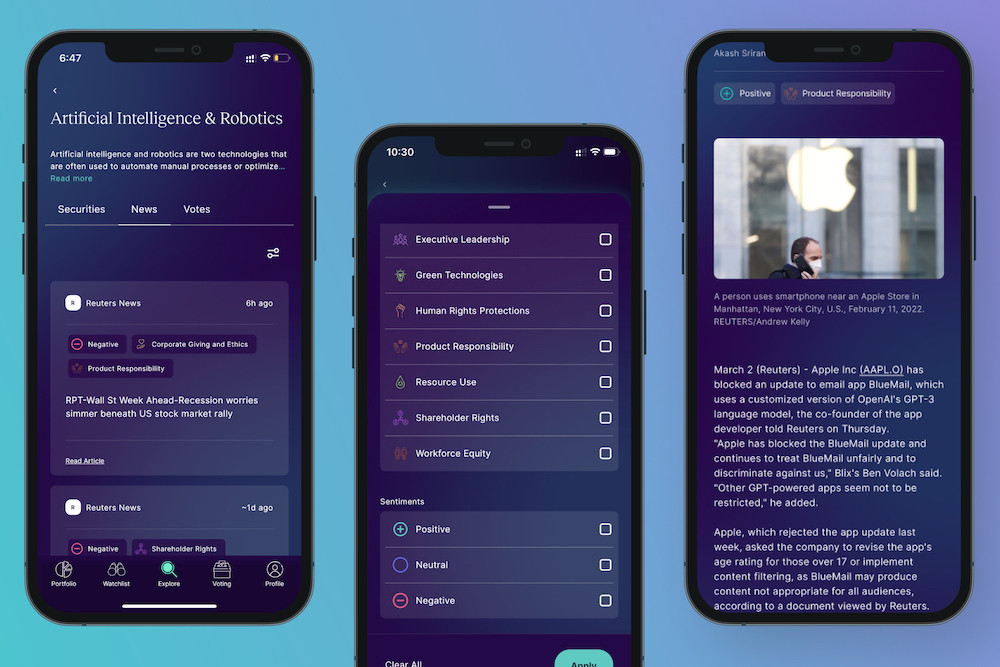

- The news feature appears in a few different places — You’ll see text that says “News” on your portfolio screen, in your watchlists, when you go to a company’s detail page, and when viewing company industry lists. Tapping on “News” or scrolling down will show you the news that relates to the company you’re looking at, or multiple companies if you’re looking at a watchlist or industry.

- News articles are added real-time — You’ll get access to news as it breaks, live updates to articles, and be able to view articles that are up to a year old.

Integrating news into an investing app is relatively common, so what is it about Fennel’s news feature that makes it unique? Two things: filtering and sentiment analysis.

ESG labels and filters

Since the team at Fennel believes that ESG can help investors become more informed about the companies they invest in, we’ve also integrated ESG into how we show news.

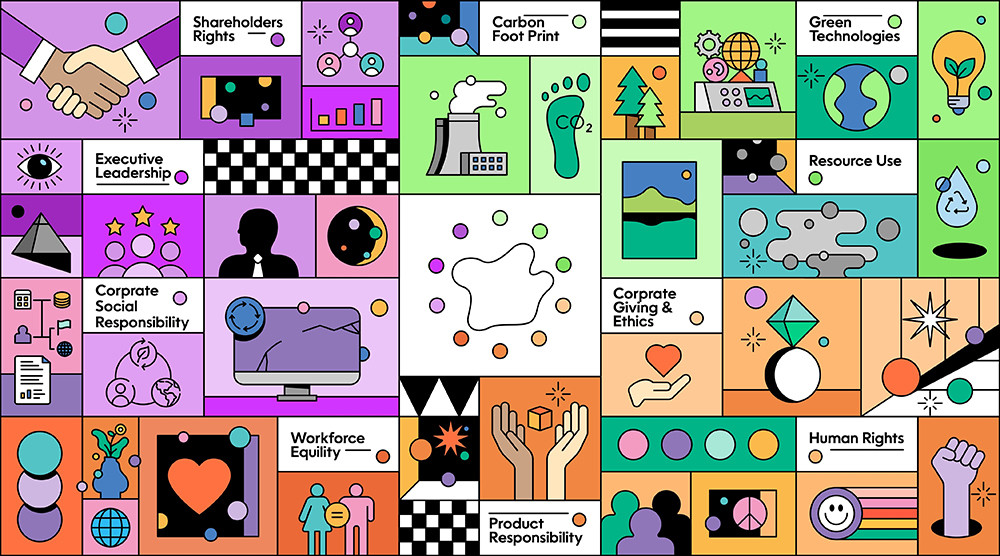

If you’ve spent some time analyzing the Fennel ESG wheel, you’ve probably noticed that Fennel provides ESG data across ten different categories. You can view a full list of those ten categories here. However, these ten categories appear outside of the ESG wheel as well — including in the news feature.

When Fennel’s news feature algorithm notices that the information in a given article relates to one of those ten categories, you’ll see one of Fennel’s ESG icons listed on that article. For example, an article about a senior executive departing a company may show the “Executive Leadership” icon because of how that news relates to this category.

You’re also able to filter news stories based on these ESG categories, so if you’re looking for articles that talk about “Green Technologies” you can turn on filters and search for them.

News sentiment analysis

If you see a news article in the Fennel app, you may see that it says “positive,” “negative,” or “neutral” at the top. What does this mean?

The Fennel app is able to show whether the general sentiment of that article is positive, negative, or neutral. Keep in mind that this sentiment analysis applies to the article as a whole and not to how an individual company or security is talked about (although, that’s a feature that may come in the future). This sentiment analysis is NOT a recommendation to buy or sell a specific security, instead it’s meant to be a helpful tool to better understand the news.

How does this sentiment tool work? The news feature algorithms analyze the language used in the article, and then determine whether that language falls into one of three buckets (either positive, negative, or neutral). The article will then get a sentiment rating based on the proportion of language that falls into each bucket.

Not every article is given a sentiment rating, but we hope that when it does appear it can help people understand the news.

Fennel is continuously expanding its news features, so stay tuned as we add more functionalities!

• • •

The views expressed are those of the author at the time of writing, are not necessarily those of the firm as a whole and may be subject to change. The information contained in this advertisement is for informational purposes and should not be regarded as an offer to sell or a solicitation of an offer to buy any. It does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of specific investors. Investing involves risk, including the loss of principal. Past performance is not indicative or a guarantee of future performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. The information and any opinions contained in this advertisement have been obtained from sources that we consider reliable, but we do not represent such information and opinions are accurate or complete, and thus should not be relied upon as such. This is particularly true during periods of rapidly changing market conditions. Employing ESG strategies may not result in favorable investment performance. Securities offered through Fennel Financials, LLC. Member FINRA SIPC.

Expand your knowledge further

Think of the Fennel ESG wheel as an ESG report card.

Some brokerages use payment for order flow to generate extra revenue, but at what cost?

If you've ever found yourself nodding along to conversations about investing while secretly wondering if everyone else in the room is speaking a different language, you're not alone.

In any market, investors are always looking for the next edge

Beta, enterprise value, expense ratio ... what does it all mean? Here are definitions for the terms you'll see in the Fennel app.

Fennel is giving you even more control over your portfolio by letting you decide how your orders get routed.

You may already know that owning stock means owning a portion of a specific company

Here's what you should know about Fennel's real-time news feature.

How a company acts affects more than just its product or its bottom line, it affects the world around it — for better or for worse

Screening is one way to incorporate ESG into your portfolio.

Take back the power of your investment